Section E

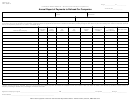

Line 6 – Guaranty Fund Assessment Credit as calculated by the Life and Health Guaranty Association. Each

company receiving a credit will receive a form from the Life and Health Guaranty Association

stating the total available premium tax credit for the year. SOFTWARE FORMS ARE NOT ALLOWED.

If you feel there is an error in this computation, please do not change this amount. You will need

to contact the Life and Guaranty Association directly at (501) 371-2776. They will make all corrections

and notify the Arkansas Insurance Department. Attach form to verify amount taken and enter here.

PROOF OF CREDIT REQUIRED WITH FILING.

Line 7 – Arkansas Comprehensive Health Insurance Pool (CHIP) credit Form #CHIP ST.SP (04). You will receive an

annual assessment fee payable to the CHIP office if you are a participating insurer in the pool. If you do not

receive your CHIP form prior to filing your annual return telling you what your credit is, contact the CHIP office at

(501) 370-2659. Attach form to verify amount taken and enter result here. PROOF OF CREDIT

REQUIRED WITH FILING. SOFTWARE FORMS ARE NOT ALLOWED.

Line 8 – Affordable Neighborhood Housing Credit (Act 1331-1997) - Insurers that perform affordable housing

assistance activities may take a premium tax credit for up to 30% of the total amount invested and not to exceed

$750,000 in any taxable year. Program must meet standards of and be approved by Arkansas Development

Finance Authority. Attach form to verify amount taken and enter result here.

Line 9 - Low Income Housing Tax Credit - Insurers are allowed a state income or premium tax credit equal to 20% of

the federal low-income housing tax credit not to exceed $250,000 in any taxable year. The credit is available for

insurers that own an interest in a qualified project for which the Arkansas Development Finance Authority

has issued an eligibility statement. Eligibility statement must be attached to verify amount taken and

enter result here.

Line 10 (a) - Credits for Arkansas Salaries-Life You must complete the SCHEDULE IC-PT, page 3 before taking

this credit; otherwise it will be disallowed. Multiply the amount on Line 1(c) by 70%, this amount cannot

exceed Line 1(c), Page 1, Col 1 and enter the result here.

Line 10 (b) - Credits for Arkansas Salaries-A&H You must complete the SCHEDULE IC-PT, page 3 before

taking this credit; otherwise it will be disallowed. Multiply the amount on Line 2(f) by 80%, this amount

cannot exceed Line 2 (f), Page 1, Col 1 and enter the result here.

**Note**The sum of 10 (a) & (b) cannot exceed Line 2 of SCHEDULE IC-PT.

Line 11 - Delta Geotourism Incentive Credit (Act 349 of 2009) – This Act provides for a tax credit for a person or

entity investing $25,000 or more in a geotourism-supporting business in the Lower Mississippi River Delta and

complies with the requirements of Section 4(a) of the Act. Geotourism is defined as tourism that sustains or

enhances the geographical character of an area. Attach form to verify amount taken and enter result

here.

Line 12 - AR Historic Rehab Income Tax Credit § 26-51-2201, et seq. – The tax credits are available to a person or

entity that invests in the revitalization and rehabilitation of historic structures throughout Arkansas. The credit is

available in the amount of 25% of the first $500,000 in qualified rehabilitation expenses on income producing

property or the first $100,000 in qualified rehabilitation expenses on non-income producing property. The

evidence to support a claim for the tax credit should be presented to the Arkansas Insurance Department.

Attach “Certificate of Income Tax Credit” issued by Department of Arkansas Heritage to verify

amount taken and enter result here.

Line 13 - Subtotal is the sum of the amount in Section D less credits listed in Section E on lines 6 – 12. Enter the result

here. If you only owe for fees, you cannot apply credits against fees.

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9