ARKANSAS FOREIGN LIFE & DISABILITY

PREMIUM TAX RETURN INSTRUCTIONS

Instructions for Page 1 of the return.

NAIC Codes

Please enter your 5-digit NAIC Company Code in the space provided and complete all lines in the company information

section. Complete Column 1 – Arkansas Tax and Column 2 – State of Domicile. Provide the Correct Tax Rate for the

Domiciliary State.

Section A

Line 1(a) - Life Insurance Direct Written Premiums – Use amount from Annual Statement, Direct Business for

Arkansas, Line 1, Life Insurance: Column 5-Total. No deduction from this amount may be made on

the Arkansas side (Col 1).

Line 1(b) - Less Army/Air Force Federal Premiums.

Line 1(c) - Arkansas tax rate is 2.5%. Multiply Line 1(a) less (b) by this rate and enter the result on Line 1(c).

Line 2(a) - Accident & Health - Enter amount from Annual Statement, Direct Business Page for Arkansas, Line

26(Total), and Column 1.

Line 2(b) - Less Federal Employees Health Benefits Program (Line 24.1)

Line 2(c) - Dividends Paid or Credited On Direct Business – Enter amount from Annual Statement, Direct Business

Page for Arkansas, Line 26 (Total), Column 3 in Accident and Health Insurance Section (bottom).

Line 2(d) - Less Medicare Title XVIII, tax exempt (Line 24.4)

Line 2(e) - Subtract Line 2(b-d) from Line 2(a). Enter result on Line 2(e), Columns 1 & 2.

Line 2(f) - Multiply Line 2(e) by 2.5% tax rate and enter the result in column 1 & 2, Line 2(f).

Line 2(g) - Additional Taxes and Fees from State of Domicile. Include any/all fees or taxes that would be required

of an insurance company doing business in your state. If your state of domicile imposes a minimum tax,

enter that amount here. Do not include special purpose ASSESSMENTS. You must attach an explanation

with computations for multiple items on this line. Use this line for fees not shown in Section B. New

York Domiciled Companies: The CT-33 and CT-33-M, New York Franchise Tax forms, prepared on the

Arkansas basis, are to be filed in Arkansas immediately upon filing the franchise information in New York.

Line 3 -

Total premium tax due Line 1(c) plus Line 2(f), enter result on line; Col 2 use Line 1(c), 2(f)(g).

Section B

Line 4(a) - Enter the annual statement-filing fee from your state of domicile in Col 2. The Arkansas side is

completed. FOR FEES OTHER THAN SHOWN HERE, LIST IN SECTION 2(e).

Line 4(b) - Enter the Certificate of Authority/annual renewal fee from your state of domicile in Col 2. The

Arkansas side is completed.

All other fees associated with the filing are to be shown in Section A, 2g.

Line 4(C) - Add together Lines 4a and 4b then enter result here in Col 2.

Section C

Line 5 - Total of all Premium Taxes and Fees Due - Add together Lines 3 plus 4c then enter result here.

Figure cannot be less than zero.

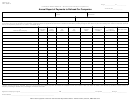

Instructions for Page 2 of return.

Section D

Follow instructions at the top of page 2, this is your tax liability. Use amount from SECTION A, LINE 3.

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9