Estate Tax - Instructions For Form 74 And Form 76 - Arizona Department Of Revenue Page 2

ADVERTISEMENT

The Arizona estate tax is a tax on the transfer of property or

interest in property. This occurs upon the death of the

owner and is levied on the net estate before it is distributed.

Arizona estate tax is imposed on the Arizona estate of both

resident and nonresident decedents. Arizona does not

impose an inheritance or gift tax.

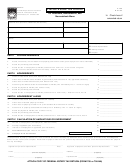

The Office of Estate Tax of the Arizona Department of

Revenue processes the estate tax returns (Form 76) for

taxable estates and reports of personal representative of

decedent (Form 74) for nontaxable estates.

An Arizona estate tax return is required to be filed when a

federal estate tax return is required. However if no federal

estate tax return is required, a report of personal

representative of decedent may be required. This report is

required to be filed in order to obtain tax waivers that are

used in probate proceedings and to terminate joint tenancy

on real property.

The Arizona estate tax return and the report of personal

representative of decedent should be mailed to the

following address:

Arizona Department of Revenue

Office of Estate Tax

1600 West Monroe, Room 610

Phoenix, AZ 85007-2650

General Instructions

Return filing requirements:

Form 76 is due on the same date as the federal estate tax

return. An extension of time for filing the Arizona estate tax

return may be obtained automatically if the federal due date

is extended. Please provide a copy of the approved federal

extension with the Arizona return. Be sure that a complete

copy of the federal estate tax return is attached to the

Arizona estate tax return.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5