Estate Tax - Instructions For Form 74 And Form 76 - Arizona Department Of Revenue Page 4

ADVERTISEMENT

same rate used by the Internal Revenue Service and starts

nine months after the date of the decedent’s death,

regardless of any extension to file the return or pay the tax.

Late filing penalty is computed at 5% of the tax due for each

month or portion thereof that a return is delinquent, up to a

maximum of 25%. Late payment penalty is computed at

10% of the amount of tax due. The maximum late filing and

late payment penalties cannot exceed 25%.

Changes in the Federal Return or Federal Estate Tax:

The Department must be notified immediately if a federal

estate tax return is amended or adjusted as a result of a

federal audit, tax refund claim, or for any other reason.

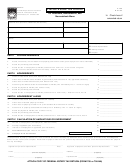

REPORT OF PERSONAL REPRESENTATIVE OF

DECEDENT (Form 74)

General Instructions

Return filing requirements:

The Form 74 is required to be filed in order to obtain tax

waivers that are used in probate proceedings and to

terminate joint tenancy on real property. Information

regarding the estate should be entered in the appropriate

areas. Sections I and III should not have any blank lines.

The type of waiver needed should be indicated in Section II.

The complete legal description of the real property needs to

be included. This is found on the property deed or on the

property tax notice. Finally, a copy of the death certificate

should be attached to the form.

For Estate Tax Forms and Information:

All correspondence should be sent to the address shown

earlier. For forms, information and assistance you may call

(602) 542-4643.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5