Estate Tax - Instructions For Form 74 And Form 76 - Arizona Department Of Revenue Page 3

ADVERTISEMENT

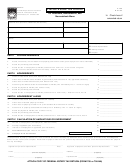

Computation of Tax:

1. Resident Decedent: The Arizona estate tax of an

Arizona resident decedent is an amount equal to the

federal state death tax credit. If the decedent owned

real or tangible personal property located in another

state, the Arizona tax is reduced by either (A) or (B),

whichever is less:

A) The amount of death tax paid to the other state and

credited against the federal estate tax, or

B) An amount computed by multiplying the federal

credit by the following fraction: the numerator is the

value of the real property and any tangible personal

property located in the other state that is subject to

the death tax imposed by that state; the

denominator is the value of the decedent’s gross

estate.

2. Nonresident decedent: The Arizona estate tax of a

nonresident decedent is computed by multiplying the

federal state death tax credit by the following fraction:

the numerator is the value of the Arizona estate and the

denominator is the value of the decedent’s gross estate.

NOTE: The Arizona estate includes real property and any

tangible personal property located in Arizona.

Payment of Tax:

The Arizona estate tax is due on the same date as the

federal estate tax, unless an extension of time for payment

has been granted, or unless an election has been made

under ARS §42-4004 to pay in installments. The Arizona

installment election can only be made if an installment

election has been made under §6166 of the Internal

Revenue Code and the Arizona estate tax exceeds

$50,000.

Interest and Penalties:

Interest on delinquent Arizona estate tax is computed at the

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5