Montana Form Est-P - Underpayment Of Estimated Tax By Individuals And Fiduciaries - 2002 Page 2

ADVERTISEMENT

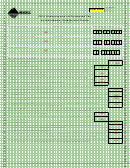

Part IV Annualized Income Installment Method Worksheet — Complete lines 29 through 53 only if computing installments

using annualized income installment method.

Complete each column beginning with Column A through line 53 before completing the next column.

A

B

C

D

1/1/02 to 3/31/02

1/1/02 to 5/31/02

1/1/02 to 8/31/02

1/1/02 to 12/31/02

29. Montana Adjusted Gross Income for the period.

29.

29.

30. Annualization amounts.

4

2.4

1.5

1

30.

30.

31. Annualized Income. Multiply line 29 by line 30.

31.

31.

32. *Enter your itemized deductions for the period shown.

32.

32.

33. Annualization amounts.

33.

4

2.4

1.5

1

33.

34.

34. Multiply line 32 by line 33.

34.

35. **Enter the full amount of your standard deduction.

35.

35.

36.

36. Enter the larger of line 34 or line 35.

36.

37.

37. Subtract line 36 from line 31.

37.

38. Multiply $1,740 by number of exemptions.

38.

38.

39.

39. Subtract line 38 from line 37.

39.

40. Figure the tax on the amount on line 39

40.

using the tax table below.

40.

41. Tax on lump sum distributions.

41.

41.

42.

42. Add lines 40 and 41.

42.

43.

43. Enter tax credits for each period.

43.

44. Subtract line 43 from line 42.

44.

44.

45.

45. Applicable percentage.

22.5%

45%

67.5%

90%

45.

46. Multiply line 44 by line 45.

46.

46.

47.

47. Add the amounts in all preceding columns of line 53.

-0-

47.

48.

48. Subtract line 47 from line 46. If less than zero enter 0.

48.

49. Divide line 6, Part I of this form, by four (4) and

49.

enter the result in each column.

49.

50. Enter the amount from line 52 of the preceding

50.

column of this worksheet.

50.

51. Add lines 49 and 50 in each column and

enter the result.

51.

51.

52. If line 51 is more than line 47, subtract line 48

from line 51. Otherwise, enter zero.

52.

52.

53. Enter the smaller of line 48 or line 51 here and on

53.

line 14 of Part III.

53.

*If you do not itemize deductions, enter zero.

** The standard deduction is 20% (.20) of line 31, subject to the following limitations:

Single or separate:

No less than $1,450; no more than $3,260

Married or head of household:

No less than $2,900; no more than $6,520

TaxTable

If Taxable Income is:

If Taxable Income is:

Over

But not over

Multiply by and Subtract = Tax

Over

But not over

Multiply by and Subtract = Tax

$

0 ..........

$ 2,200 .... X .... 2 % ........ $

0 ..............

$17,400 .... $21,800 .... X ...... 7 % .............. $

458

$ 2,200 ..........

$ 4,400 .... X .... 3 % ........ $ 22 .............

$21,800 .... $30,500 .... X ...... 8 % .............. $

676

$ 4,400 ..........

$ 8,700 .... X .... 4 % ........ $ 66 .............

$30,500 .... $43,500 .... X ...... 9 % .............. $

981

$ 8,700 ..........

$13,100 .... X .... 5 % ........ $ 153 .............

$43,500 .... $76,200 .... X ...... 10 % .............. $ 1,416

$13,100 ..........

$17,400 .... X .... 6 % ........ $ 284 .............

$76,200 ...................... X ...... 11 % .............. $ 2,178

Example = taxable income $2,400 x 3% (.03) = $72 subtract $22 = $50 tax

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2