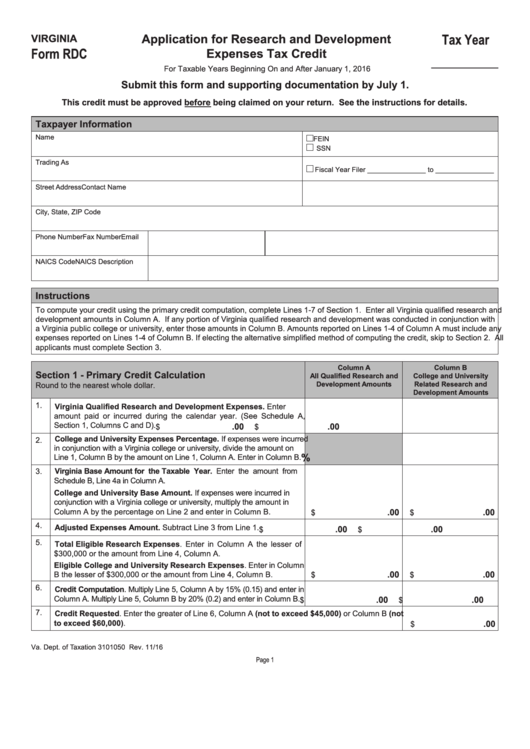

Application for Research and Development

VIRGINIA

Tax Year

Form RDC

Expenses Tax Credit

__________

For Taxable Years Beginning On and After January 1, 2016

Submit this form and supporting documentation by July 1.

This credit must be approved before being claimed on your return. See the instructions for details.

Taxpayer Information

Name

FEIN

SSN

Trading As

Fiscal Year Filer _______________ to _______________

Street Address

Contact Name

City, State, ZIP Code

Phone Number

Fax Number

Email

NAICS Code

NAICS Description

Instructions

To compute your credit using the primary credit computation, complete Lines 1-7 of Section 1. Enter all Virginia qualified research and

development amounts in Column A. If any portion of Virginia qualified research and development was conducted in conjunction with

a Virginia public college or university, enter those amounts in Column B. Amounts reported on Lines 1-4 of Column A must include any

expenses reported on Lines 1-4 of Column B. If electing the alternative simplified method of computing the credit, skip to Section 2. All

applicants must complete Section 3.

Column A

Column B

Section 1 - Primary Credit Calculation

All Qualified Research and

College and University

Development Amounts

Related Research and

Round to the nearest whole dollar.

Development Amounts

1.

Virginia Qualified Research and Development Expenses. Enter

amount paid or incurred during the calendar year. (See Schedule A,

Section 1, Columns C and D).

.00

.00

$

$

College and University Expenses Percentage. If expenses were incurred

2.

in conjunction with a Virginia college or university, divide the amount on

%

Line 1, Column B by the amount on Line 1, Column A. Enter in Column B.

3.

Virginia Base Amount for the Taxable Year. Enter the amount from

Schedule B, Line 4a in Column A.

College and University Base Amount. If expenses were incurred in

conjunction with a Virginia college or university, multiply the amount in

Column A by the percentage on Line 2 and enter in Column B.

.00

.00

$

$

4.

Adjusted Expenses Amount. Subtract Line 3 from Line 1.

.00

.00

$

$

5.

Total Eligible Research Expenses. Enter in Column A the lesser of

$300,000 or the amount from Line 4, Column A.

Eligible College and University Research Expenses. Enter in Column

B the lesser of $300,000 or the amount from Line 4, Column B.

.00

.00

$

$

6.

Credit Computation. Multiply Line 5, Column A by 15% (0.15) and enter in

Column A. Multiply Line 5, Column B by 20% (0.2) and enter in Column B.

.00

.00

$

$

7.

Credit Requested. Enter the greater of Line 6, Column A (not to exceed $45,000) or Column B (not

to exceed $60,000).

.00

$

Va. Dept. of Taxation 3101050

Rev. 11/16

Page 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9