Definitions

Where to Submit Application

“Virginia gross receipts” means the whole, entire, total receipts,

Submit Form RDC and attachments to the Department of Taxation,

without deduction.

ATTN: Tax Credit Unit, P.O. Box 715, Richmond, VA 23218-0715

or fax it to (804) 774-3902

“Virginia qualified research” means qualified research, as defined

in IRC § 41(d), as amended, that is conducted in Virginia. In

What to Expect from the Department

general, this is research that is undertaken for the purpose of

If the Department needs additional information the agency will

discovering information that is technological in nature and the

contact you by September 1 and you will have until September

application of which is intended to be useful in the development of

15 to respond. If you have not received acknowledgement of your

a new or improved business component of the taxpayer.

application by September 15, call (804) 786-2992.

“Virginia qualified research and development expenses” means

The Department will issue the credit by September 30. If you

qualified research expenses, as defined in IRC § 41(b), as

have not received your credit certification by October 15, call

amended, incurred for Virginia qualified research. In general, this

(804) 786-2992.

is the sum of the in-house research expenses and the contract

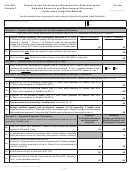

What Does the Taxpayer Need to Do

research expenses.

Upon receiving notification of the allowable credit amount, taxpayers

Stem Cell Research

may claim the allowable credit amount on the applicable Virginia

Research and development expenses that are paid or incurred for

income tax return. Taxpayers who do not receive notification of

research conducted in Virginia on human cells or tissue derived

allowable credit amounts before their Virginia income tax return

from induced abortions or from stem cells obtained from embryos

due date may file during the extension period or file their regular

do not qualify for the credit. However, if a taxpayer engaged in

return without the credit and then file an amended tax return after

research in Virginia on human cells or tissue derived from induced

receipt of notification of the allowable credit amount to claim the tax

abortions or from stem cells obtained from human embryos, it may

credit. As an attachment to their return, a corporation must file Form

receive a nonrefundable credit for other Virginia qualified research

500CR; an individual must file Schedule CR; and a pass-through

and development expenses.

If the amount of nonrefundable

entity must file Form 502ADJ.

credit that a taxpayer is allowed to claim exceeds the taxpayer’s

IMPORTANT

tax liability for the taxable year, then the excess amount of credit

will not be refunded to the taxpayer and cannot be carried over

Online Worksheet: A spreadsheet template is available for

to future taxable years. Research and development expenses

download on our website, Use this

that are paid or incurred for research conducted in Virginia on

spreadsheet to compute the Virginia Base Amount when using

nonhuman embryonic stem cells may qualify for the credit.

the primary calculation method to compute the Research and

Development Expenses Tax Credit.

When to Submit Application

All business taxpayers should be registered with the Department

Form RDC and any supporting documentation must be completed

before completing Form RDC. If you are not registered, complete

and mailed no later than July 1.

Form R-1.

For any application received without a postmark, the date received

If the tax return upon which this credit will be claimed is due on or

by the Department will be used to determine if the application was

before September 30, you may need to either submit an extension

received by the filing deadline.

payment for any tax due or file an amended return once you have

What to Attach

received the credit certification.

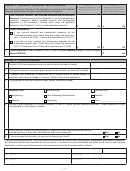

To allow us to process this application, provide the following:

Pass-Through Entities

•

Outline of the type of research and development being

Effective for taxable years beginning on or after January 1, 2014,

conducted in Virginia.

a partnership, limited liability company, or electing small business

•

Details regarding the qualified contractors:

corporation (S corporation) may elect to receive and claim the

credit at the entity level. If this election is not made, credits must

1.

Location where research was conducted

be allocated to the individual partners, members, or shareholders

2.

Length of time spent on project

in proportion to their ownership interests in such entities or in

accordance with a written agreement entered into by such individual

3.

Type of research conducted

partners, members, or shareholders.

4.

Payroll expenses

In order to allocate the credit to the partners, shareholders, or

5.

Total qualified expenses

members, each pass-through entity must file Form PTE with

the Department within 30 days after the credit is granted. This

•

Attach a copy of the research agreement if reporting expenses

information should be sent to: Department of Taxation, ATTN: Tax

in connection with the Virginia public or private college or

Credit Unit, P.O. Box 715, Richmond, VA 23218-0715 or you may

university.

fax it to (804) 774-3902. Please do not do both.

•

All applicants must complete and attach Schedule A. If claiming

All pass-through entities distributing this credit to their

the Research and Development Credit on the basis of qualified

owner(s), shareholders, partners or members must give each a

wages, be sure to complete Section 2 of the Schedule A in

Schedule VK-1, Owner’s Share of Income and Virginia Modifications

addition to Section 1. Copies of Schedule A can be submitted

and Credits.

if additional space is needed. You must retain a copy of any

supporting documentation of these expenditures.

Where To Get Help

Upon request, you may be required to provide proof of purchase,

Write to the Department of Taxation, ATTN: Tax Credit Unit,

such as an invoice, receipt, cancelled check, bank statement, or

P.O. Box 715, Richmond, VA 23218-0715 or call (804) 786-2992.

credit card statement.

Page 8

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9