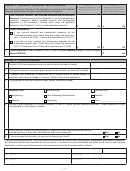

Section 2 - Alternative Simplified Credit Calculation

Column A

Column B

All Qualified Research and

College and University

See instructions and Schedule C for information on calculating the Adjusted

Development Amounts

Related Research and

Calendar Year Qualified Research and Development Expenses.

Development Amounts

1.

Total Adjusted Calendar Year Qualified Research and Development

Expenses. Enter the amount(s) from Schedule C, Line 4e in the applicable

column(s). Taxpayers without qualified research and development

expenses for the preceding 3 taxable years, enter the applicable

amount(s) from Schedule C, Line 1a in the applicable column(s).

.00

.00

$

$

2.

Credit Computation.

If you incurred research and development expenses for the

3 preceding taxable years, check here and multiply the amount on

Line 1, Column A and Line 1, Column B (if applicable) by 10% (0.1).

If you did not incur research and development expenses for the

3 preceding taxable years, check here and multiply the amount on

Line 1, Column A and Line 1, Column B (if applicable) by 5% (0.05).

.00

.00

$

$

3.

Credit Requested. Enter the greater of Line 2, Column A (not to exceed $45,000) or Column B (not to

exceed $60,000).

.00

$

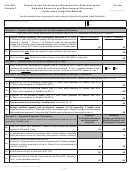

Section 3 - Credit Information

1.

Number of full time employees during the year for which the credit is sought.

2.

Total gross receipts or anticipated gross receipts for the taxable year the credit is sought.

If research was conducted in conjunction with a Virginia public or private college or

3.

university, enter name of college or university. Attach a copy of the agreement.

4.

If you applied for any other credits this year, identify the credit(s) below.

5.

Research Field:

Biotechnology

Cyber Security

Engineering

Food & Beverage Development

Industrial

Medical

Technology

Other ______________________

6.

Provide a brief description of the area, discipline, or field of Virginia qualified research performed. Attach statement or other

documentation if more space is needed.

Do you conduct research and development in Virginia on human cells or tissue derived from

7.

induced abortions or from stem cells obtained from human embryos?

Yes

No

8.

If you are a pass-through entity, do you plan to allocate your credit?

Yes

No

I (we) the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements,

and attachments) has been examined by me (us) and is, to the best of my (our) knowledge and belief, a true, correct, and complete

application, made in good faith pursuant to the income tax laws of the Commonwealth of Virginia.

Authorized Signature

Title

Date

Printed Name

Phone Number

Email Address

Fax Number

Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9