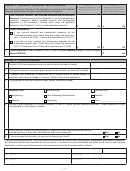

Form RDC

Research and Development Expenses Worksheet for

Tax Year

Schedule B

Computing Virginia Base Amount (Primary Method)

_________

Use this schedule when computing the credit using the Primary Credit Calculation.

Name as it Appears on Form RDC

FEIN

SSN

Section 1 - VA Qualified Research and Development Expenses

Fiscal year filers: Include expenditures and gross receipts for Calendar Year 2016 (CY), regardless of fiscal year (FY) incurred.

1a. VA Qualified Research and Development Expenses in CY 2016. (For FY filers, this will include a

.00

portion of 2 taxable years.

1b. Short year filers only: Enter the number of months included in the short year.

.00

1c. Short year filers only: Divide the number of months in Line 1b by 12.

.00

Section 2 - Determine the Fixed Base Percentage

The Average Qualified Research and Development Expenses for the 3 taxable years ending before the CY 2016.

2a. Expenses for the third preceding taxable year (CY filers, enter expenses for Taxable Year 2013.

FY filers, enter expenses for Taxable Year 2012).

.00

2b. Expenses for the second preceding taxable year (CY filers, enter expenses for Taxable Year 2014.

FY filers, enter expenses for Taxable Year 2013.)

.00

2c. Expenses for the preceding taxable year (CY filers, enter expenses for Taxable Year 2015.

FY filers, enter expenses for Taxable Year 2014.)

.00

2d. Total Expenses Add Lines 2a - 2c

.00

2e. Average Qualified Research and Development Expenses for the Prior 3 Taxable Years

.00

Divide amount on Line 2d by 3

The Average Total Gross Receipts for the 3 taxable years ending before the CY 2016.

2f. Gross receipts for the third preceding taxable year (CY filers, enter the gross receipts for Taxable Year

2013. FY filers enter gross receipts for Taxable Year 2012.)

.00

2g. Gross receipts for the second preceding taxable year (CY filers, enter gross receipts for Taxable Year

2014. FY filers enter gross receipts for Taxable Year 2013.)

.00

2h. Gross receipts for the preceding taxable year (CY filers, enter gross receipts for Taxable Year 2015.

FY filers enter gross receipts for Taxable Year 2014.)

.00

2i. Total Gross Receipts Add Lines 2f through 2h

.00

2j. Average Gross Receipts for Prior 3 Taxable Years Divide Line 2i by 3

.00

2k. Percentage of Virginia Qualified Research and Development Expenses Divide Line 2e by 2j

(round to 4 decimal places)

%

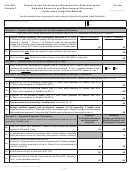

Section 3 - Determine the Virginia Base Amount

The Average Total Gross Receipts for the 4 taxable years ending before the CY 2016.

3a. Gross receipts for the fourth preceding taxable year (CY filers, enter gross receipts for Taxable Year

2012. FY filers enter gross receipts for Taxable Year 2011.)

.00

3b. Gross receipts for the third preceding taxable year (CY filers, enter gross receipts for Taxable Year

2013. FY filers enter gross receipts for Taxable Year 2012.)

.00

3c. Gross receipts for the second preceding taxable year (CY filers, enter gross receipts for Taxable Year

2014. FY filers enter gross receipts for Taxable Year 2013.)

.00

3d. Gross receipts for the preceding taxable year (CY filers, enter gross receipts for Taxable Year 2015. FY

filers enter gross receipts for Taxable Year 2014.)

.00

3e. Total Gross Receipts Add Lines 3a through 3d

.00

3f. Average Gross Receipts for Prior 4 Taxable Years Divide Line 3e by 4

.00

3g. Base Amount Calendar Year Filers: Multiply Line 2k by Line 3f

Short Year Filers: Multiply Line 2k by Line 3f. Then multiply the product by Line 1c

.00

Section 4 - Virginia Base Amount

4a. Virginia Base Amount Your Virginia Base Amount is the greater of the amount on Line 3g OR 50%

(0.5) of the 2016 Virginia Qualified Expenses from Line 1a. Enter here and on Form RDC, Section 1,

Line 3, Column A.

.00

Page 5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9