Application Instructions for the Research and Development Expenses Tax Credit

General Information

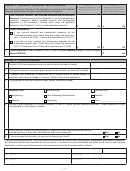

Determine Fixed Base Percentage:

The Research and Development Expenses Tax Credit may be

Step 1

Determine the average amount of Virginia qualified

claimed against individual and corporate income taxes for qualified

research and development expenses for the three

research and development expenses for taxable years beginning

taxable years preceding the year in which the tax credit is

on or after January 1, 2011, but before January 1, 2022.

being claimed. If the taxpayer has been in business for

less than three years, but at least one, use the number of

If the taxpayer elects the primary method of computing the credit,

years in business instead of three.

the tax credit amount is equal to (i) 15% of the first $300,000 in

Virginia qualified research and development expenses, or (ii) 20%

Step 2

Determine the average of the total gross receipts for the

of the first $300,000 of Virginia qualified research and development

three taxable years preceding the taxable year that the

expenses if the research was conducted in conjunction with a

tax credit is being claimed, or the number of years used

Virginia public or private college or university, to the extent the

in Step 1a, if less.

expenses exceed the base amount. The credit amount cannot

Step 3

Calculate the percentage of Virginia qualified research and

exceed $45,000 or $60,000 if the Virginia qualified research was

development expenses by dividing the average amount

conducted in conjunction with a Virginia public or private university.

determined in Step 1 by the average amount determined

For taxable years beginning on or after January 1, 2016, at the

in Step 2. This is the “Fixed Base Percentage.”

election of the taxpayer, an alternative simplified calculation may

Do not make any adjustments to account for a short taxable year

be used to determine the Research and Development Expenses

when computing the fixed-base percentage.

Tax Credit. The alternative simplified calculation of the Research

Determine the Virginia Base Amount:

and Development Expenses Tax Credit is equal to: 10% of the

difference of (i) the Virginia qualified research and development

Step 4

Determine average of the total gross receipts for the four

expenses paid or incurred by the taxpayer during the taxable

taxable years preceding the taxable year that the tax

year and (ii) 50% of the average Virginia qualified research and

credit is being claimed, or the number of years used for

development expenses paid or incurred by the taxpayer for the

Step 2, if less. For purposes of determining the Virginia

three taxable years immediately preceding the taxable year for

base amount, if any of the taxable years preceding the

which the credit is being determined. If the taxpayer did not pay or

credit year that must be accounted for when computing

incur Virginia qualified research and development expenses in any

the credit is a short taxable year, the gross receipts for

one of the three taxable years immediately preceding the taxable

such year(s) are deemed to be equal to the gross receipts

year for which the credit is being determined, the tax credit is equal

actually derived in that year, multiplied by 12, and divided

to 5% of the Virginia qualified research and development expenses

by the number of months in that year.

paid or incurred by the taxpayer during the relevant taxable year.

Step 5

Multiply the fixed base percentage in Step 3 by the

The aggregate amount of credits allowed to each taxpayer cannot

average gross receipts in Step 4.

exceed $45,000 or $60,000 if the Virginia qualified research was

conducted in conjunction with a Virginia public or private university.

Step 6

Determine the greater of the amount in Step 5 or 50% of

Virginia qualified research expenses for the credit year.

There is a $7 million cap on the total amount of credits allowed in

This is the “Virginia Base Amount.”

any fiscal year. If the total amount of tax credits applied for exceed

the $7 million limit, credits will be apportioned on a pro rata basis.

Refer to Schedule B, the Research and Development Expenses

Worksheet for Computing Virginia Base Amount, for detailed

If the total amount of approved tax credits is less than the $7 million

instructions on calculating the base amount.

credit cap, the Department will allocate the remaining amount,

on a pro rata basis, to taxpayers already approved for the credit

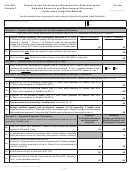

Computing the Average Amount of Virginia Qualified Research

that were subject to the $45,000 and $60,000 credit limitations.

and Development Expenses for Determining the Credit Using

Supplemental credits will be in the following amounts: if a taxpayer

the Alternative Simplified Method

elected the primary computation, an amount equal to 15% of the

If electing to compute the Research and Development Expenses

second $300,000 in qualified research expenses (or 20% of such

Tax Credit using the Alternative Simplified Method, the taxpayer

expenses if the research is conducted in conjunction with a Virginia

must complete Schedule C to determine the average amount of

public or private college or university); or if the taxpayer elected the

Virginia qualified research and development expenses on which

alternative simplified method of computing the credit, in an amount

the credit amount will be calculated. Taxpayers who calculate

equal to the excess of the limitation. The maximum supplemental

the credit based on less than 3 years of qualified research and

credit amount is $45,000, or $60,000 if the research is conducted

development expenses must complete Sections 1 and 2 on

in conjunction with a Virginia public or private university.

the Schedule C. Taxpayers who calculate the credit based on

Any taxpayer who is allowed a research and development

qualified research and development expenses for the 3 taxable

expenses tax credit is not allowed to use the same expenses as

years preceding the credit year must complete all sections of

the basis for claiming any other Virginia tax credit. No taxpayer may

Schedule C.

claim both this credit and the Major Research and Development

When determining the average amount of Virginia qualified

Expenses Tax Credit.

research and development expenses for the three years preceding

For additional information regarding the credit, see the Research

the credit year, if one or more of the three taxable years preceding

and Development Expenses Tax Credit Guidelines, which are

the credit year is a short taxable year, then the Virginia qualified

available on the Department’s website at

research and development expenses for such year must be

modified by multiplying that amount by 365 (366 in a leap year)

Determining the Virginia Base Amount for the Primary

and dividing the result by the number of days in the short taxable

Research and Development Expenses Tax Credit

year.

In order to determine the Virginia Base Amount for the primary

credit computation, follow these steps:

Page 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9