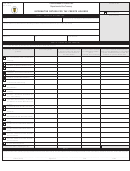

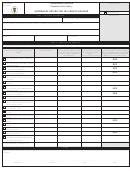

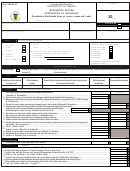

Form 480.60 Ci - Informative Return Corporation Of Individuals Page 3

ADVERTISEMENT

Commonwealth of Puerto Rico

Department of the Treasury

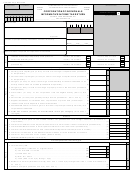

INFORMATIVE RETURN - CORPORATION OF INDIVIDUALS

Rev. 05.13

STOCKHOLDER'S DISTRIBUTABLE SHARE ON THE

INCOME, LOSSES AND CREDITS

FORM 480.60 CI

INSTRUCTIONS

GENERAL INSTRUCTIONS

Such payments must be deposited in the Department of the Treasury

in 4 equal installments not later than the 15

day of the fourth, sixth,

th

OBLIGATION TO FILE THE CORPORATION OF INDIVIDUALS

ninth and twelfth month of the corporation of individuals’ taxable year.

INFORMATIVE RETURN

In the case of a stockholder that is a nonresident alien individual, the

Every corporation of individuals that is required to file a Corporation of

amount to be withheld attributable to its distributable share on the net

Individuals Informative Income Tax Return must provide to each

income from the corporation of individuals will be determined on a

stockholder a report containing the information required to be included

29% basis.

on the stockholder’s income tax return. The information must be provided

in Form 480.60 CI (Corporation of Individuals Informative Return –

The tax withheld will be sent to the Department of the Treasury using

Stockholder’s Distributable Share on Income, Losses and Credits).

Form 480.9A (Withholding Tax Payment Voucher) or substitute form.

The deposit must be made not later than the 15

day following the

th

Each stockholder must submit this Informative Return with the income

close of the calendar month to which the withholding belongs.

tax return.

HOW MUST THE STOCKHOLDERS REPORT THESE ITEMS IN

DATE ON WHICH THE REPORT MUST BE PROVIDED TO

THEIR INCOME TAX RETURNS?

STOCKHOLDERS

The stockholders must include each one of the items indicated in their

The corporation of individuals has until the last day of the third month

income tax returns as if such items were realized directly by them,

following the close of the taxable year to provide the informative return

since the Code provides that the nature, source and character of the

to the stockholders. Copy of the stockholder’s report must be

income, gains, losses and credits items included in the stockholder’s

sent to the Department of the Treasury together with the

distributable share will be determined as if such items were realized

Corporation of Individuals Informative Income Tax Return

by the stockholder directly from the source from which the corporation

(Form 480.20(I)) when the same is filed.

of individuals realized them, or incurred in the same way that they

were incurred by the corporation of individuals. In the same way, the

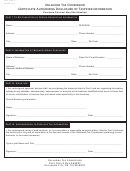

REQUEST FOR EXTENSION OF TIME TO FILE THE

stockholder’s distributable share on income from sources outside of

STOCKHOLDER’S REPORT

Puerto Rico earned by the corporation of individuals will retain the

character of the income from sources outside of Puerto Rico in the

A 30 days automatic extension of time will be granted from the date

hands of the stockholder.

prescribed to file the stockholder’s report. This will be made through

the Request for Extension of Time to File Reports of Partnership,

Nevertheless, Section 1115.04(c) of the Code provides that the

Special Partnership, Corporation of Individuals, Employees-Owned

stockholder may elect to treat its distributable share on lines 1, 2, 4,

Special Corporation and Revocable Trust or Grantor Trust (Form

5, 8, 9, 10 and 11 of Part III as part of the corporation of individuals’

AS 2644.1).

net income or loss. In this case, the amount allowable as a deduction

for its distributable share on the loss from the sale or exchange of

ESTIMATED PAYMENT REQUIREMENT ON STOCKHOLDER’S

capital assets by the corporation of individuals will be limited to the

DISTRIBUTABLE SHARE

stockholder’s distributable share on the capital gains realized by the

corporation. Once the election is made for a particular taxable year,

Section 1062.05 of the Puerto Rico Internal Revenue Code of 2011,

the same is irrevocable with respect to such year.

as amended (Code), provides the requirements for the income tax

estimated payments attributable to the stockholder’s distributable

SPECIFIC INSTRUCTIONS

share on the income from the corporation of individuals.

Enter the information required in each space. The corporation of

The managing stockholder or any other persons to whom the

individuals is required to provide this informative return to each

obligation to provide the report to the stockholders has been

stockholder completed in all parts, so the stockholder can complete

delegated, must withhold and send an amount equal to 30% of the

the income tax return to be filed with the Department of the Treasury.

estimated total of stockholder’s distributable share on the income items

from a corporation of individuals, less the total withheld with respect

Enter the name and address of the stockholder and corporation of

to judicial or extrajudicial indemnification payments and payments for

individuals, as well as the social security number, employer

services rendered. This percentage applies when the stockholder

identification number and type of industry.

is a resident individual, a nonresident american citizen and certain

trusts.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6