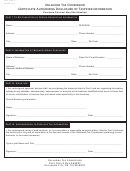

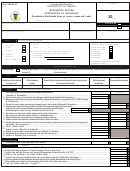

Form 480.60 Ci - Informative Return Corporation Of Individuals Page 4

ADVERTISEMENT

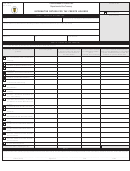

Informative Return Corporation of Individuals

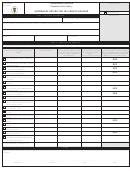

Line 2 - Net short-term gain (or loss) on sale or exchange of

PART I – STOCKHOLDER’S INFORMATION

capital assets

Indicate on lines A through F, the information that describes what

Enter on this line the stockholder's distributable share on the gain or loss

applies to the stockholder, as it corresponds.

derived from the sale or exchange of capital assets held by the

corporation of individuals for six (6) months or less.

Line D – Indicate the stockholder’s share on the debts incurred by

the corporation of individuals, including obligations guaranteed and

Line 5 - Net income (or loss) from the corporation of

non guaranteed by such stockholder. The stockholder’s basis will

individuals’ trade or business

increase by those obligations guaranteed by such stockholder.

Include on this line the stockholder's distributable share on the net

PART II – ANALYSIS OF STOCKHOLDER’S CAPITAL

income or loss from the operations of the eligible activities. Do not

ACCOUNT

include in this item gains or losses identified on other lines of this Part.

Column (a) – Enter any capital contributed by the stockholder during

Enter on line 5(a) the share of the corporation of individuals’ net

the taxable year.

income attributable to services rendered by the stockholder and not

paid to the stockholder as salaries or compensation for services

Column (b) – Enter any other basis increase attributable to the

rendered.

stockholder.

The amount on line 5(a) must be reported by the stockholder as

Column (c) – Enter the stockholder’s distributable share on the gains

income from services or from trade or business in its income tax

or losses from the corporation of individuals during the taxable year.

return.

Column (d) – Enter the amount attributed to withdrawals or

Enter on line 5(b) the difference between the amount on line 5 and

distributions made by the corporation of individuals to the stockholder,

the amount attributable to the services rendered by the stockholder

excluding the amount attributed to income tax for withholdings at

reported on line 5(a).

source on the distributable share made to a nonresident stockholder

(30%) or to a nonresident alien stockholder (29%).

The amount on line 5(b) must be informed by the stockholder on

Schedule R of its income tax return.

Column (e) – Enter the amount attributed to other decreases to the

stockholder’s basis in the corporation of individuals.

Line 6 - Net income (or loss) from partially exempt income

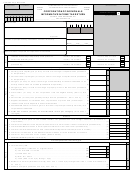

For purposes of computing the loss that you are entitled to claim, you

Enter on this line the stockholder's distributable share on the net

must determine the adjusted basis of the stockholder’s interest

income or loss from operations under Act No. 52 of 1983, Act No. 47

according to Section 1115.05 of the Code.

of 1987, Act 78-1993, Act 225-1995, Act 74-2010 or Act 132-2010.

The stockholder’s losses in one or more corporations of individuals are

Line 7 - Net income (or loss) from income subject to a

allowed as a deduction against the income from other corporations of

preferential rate

individuals and against income from partnerships or special partnerships

in which the stockholder is a shareholder. Each loss may be considered

Enter on this line the stockholder's distributable share on the net

up to the amount of the adjusted basis of the stockholder’s interest in each

operating income or loss subject to a fixed special tax rate. Enter in

corresponding corporation of individuals.

the second Column the tax determined and deposited by the

corporation of individuals, as determined on Form 480.20(I).

The limitation of the adjusted basis will be computed for each one of

the corporations of individuals in which the stockholder invests.

Line 8 - Eligible distribution of dividends from corporations

If the loss deduction allowable to the stockholder for any taxable year

Enter on this line the stockholder’s distributable share on the

is less than its distributable share in the partnership’s net loss, the

dividends received by the corporation of individuals at a preferential

stockholder may claim such excess as a deduction in any future

tax rate of 10%. In the second Column you must enter the

taxable year, subject to the previously explained limitations.

stockholder’s share on the tax withheld.

PART III – DISTRIBUTABLE SHARE PER CATEGORY

The stockholders may claim separately in their returns, their

distributable share on the dividends received by the corporation of

Enter in each one of the spaces provided the stockholder’s

individuals and claim a credit for their share on the 10% tax withheld.

distributable share on the applicable item and the corresponding tax

withheld, if any.

As elected by the stockholders, said income may be included in the

corporation of individuals’ net income to determine the corporation of

Line 1 - Net long-term gain (or loss) on sale or exchange of

individuals’ income or loss, as provided by Section 1115.04(c) of the

capital assets

Code.

Enter on this line the stockholder's distributable share on the gain or loss

derived from the sale or exchange of capital assets held by the

corporation of individuals for more than six (6) months.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6