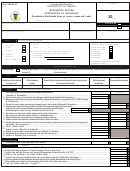

Form 480.60 Ci - Informative Return Corporation Of Individuals Page 6

ADVERTISEMENT

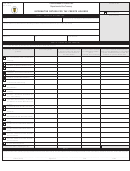

Informative Return Corporation of Individuals

Line 7 - Other credits not included on the preceding lines

Enter on this line the stocksholder's share on the total amount of other

credits not included on the preceding lines. If on this line you included

credits from different concepts, you must submit a schedule showing

a breakdown of such credits. You must also submit documents or

evidences to support every credit claimed on this line.

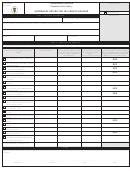

PART VI – TAXES PAID TO FOREIGN COUNTRIES AND

THE UNITED STATES, ITS TERRITORIES AND

POSSESSIONS

Enter in this part the stockholder’s distributable share on the net

income from sources outside of Puerto Rico derived by the

corporation of individuals and on the taxes paid by the corporation

of individuals outside of Puerto Rico on said net income. This Part VI

provides space to include the income per country of up to 3 countries,

in addition to the Unites States. If there is income derived from more

than 3 countries, please submit a schedule breaking down the net

income and tax paid to each country.

Line 1 – Net income from sources within the country, territory

or possession

Enter on this line the stockholder’s distributable share on the net

income from sources outside of Puerto Rico derived by the

corporation of individuals. This amount must be reported per country,

as determined on line 3, Part I of Schedule C Corporation submitted

by the corporation of individuals with its Corporation of Individuals

Informative Income Tax Return (Form 480.20(I)).

Line 2 - Tax paid or accrued during the year to a foreign

country, the United States, its territories or possessions

Enter on this line the stockholder’s distributable share on the income

tax paid or accrued to the United States, its possessions or foreign

country as reported in Part II of Schedule C Corporation submitted

by the corporation of individuals with its Corporation of Individuals

Informative Income Tax Return (Form 480.20(I)).

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6