Sc Schedule Tc-35 - Alternative Motor Vehicle Credit - South Carolina Department Of Revenue

ADVERTISEMENT

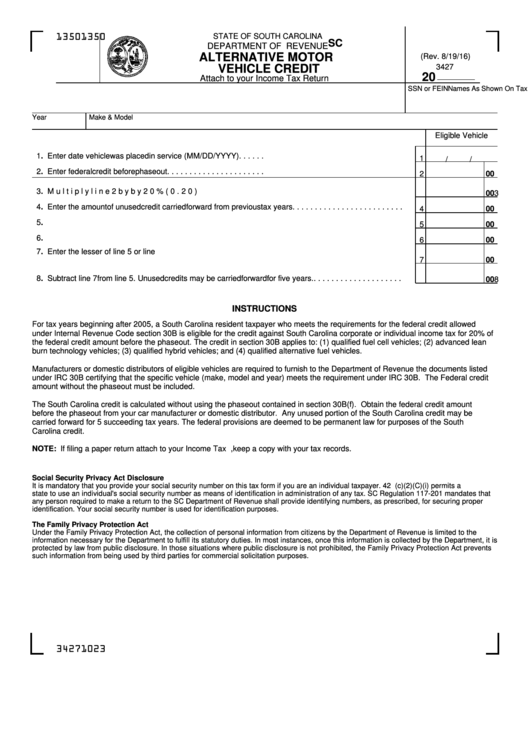

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-35

DEPARTMENT OF REVENUE

ALTERNATIVE MOTOR

(Rev. 8/19/16)

VEHICLE CREDIT

3427

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SSN or FEIN

Year

Make & Model

Eligible Vehicle

1. Enter date vehicle was placed in service (MM/DD/YYYY). . . . . .

1

/

/

2. Enter federal credit before phaseout . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Multiply line 2 by by 20% (0.20). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4. Enter the amount of unused credit carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. Add lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. Enter your current tax liability. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7. Enter the lesser of line 5 or line 6. This is your current year credit. Enter this amount on the appropriate

tax credit schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Subtract line 7 from line 5. Unused credits may be carried forward for five years. . . . . . . . . . . . . . . . . . . . .

8

00

INSTRUCTIONS

For tax years beginning after 2005, a South Carolina resident taxpayer who meets the requirements for the federal credit allowed

under Internal Revenue Code section 30B is eligible for the credit against South Carolina corporate or individual income tax for 20% of

the federal credit amount before the phaseout. The credit in section 30B applies to: (1) qualified fuel cell vehicles; (2) advanced lean

burn technology vehicles; (3) qualified hybrid vehicles; and (4) qualified alternative fuel vehicles.

Manufacturers or domestic distributors of eligible vehicles are required to furnish to the Department of Revenue the documents listed

under IRC 30B certifying that the specific vehicle (make, model and year) meets the requirement under IRC 30B. The Federal credit

amount without the phaseout must be included.

The South Carolina credit is calculated without using the phaseout contained in section 30B(f). Obtain the federal credit amount

before the phaseout from your car manufacturer or domestic distributor. Any unused portion of the South Carolina credit may be

carried forward for 5 succeeding tax years. The federal provisions are deemed to be permanent law for purposes of the South

Carolina credit.

NOTE: If filing a paper return attach to your Income Tax Return. If filing electronically, keep a copy with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a

state to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that

any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper

identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the

information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is

protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents

such information from being used by third parties for commercial solicitation purposes.

34271023

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1