Instructions For Schedule We

ADVERTISEMENT

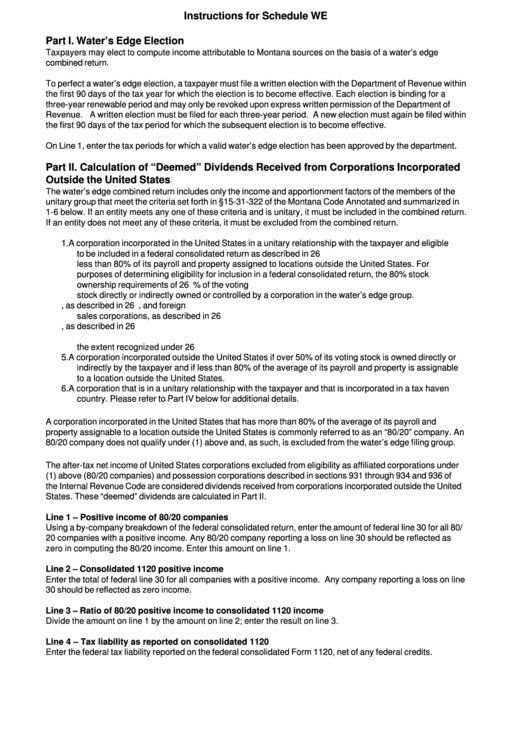

Instructions for Schedule WE

Part I. Water’s Edge Election

Taxpayers may elect to compute income attributable to Montana sources on the basis of a water’s edge

combined return.

To perfect a water’s edge election, a taxpayer must file a written election with the Department of Revenue within

the first 90 days of the tax year for which the election is to become effective. Each election is binding for a

three-year renewable period and may only be revoked upon express written permission of the Department of

Revenue. A written election must be filed for each three-year period. A new election must again be filed within

the first 90 days of the tax period for which the subsequent election is to become effective.

On Line 1, enter the tax periods for which a valid water’s edge election has been approved by the department.

Part II. Calculation of “Deemed” Dividends Received from Corporations Incorporated

Outside the United States

The water’s edge combined return includes only the income and apportionment factors of the members of the

unitary group that meet the criteria set forth in §15-31-322 of the Montana Code Annotated and summarized in

1-6 below. If an entity meets any one of these criteria and is unitary, it must be included in the combined return.

If an entity does not meet any of these criteria, it must be excluded from the combined return.

1. A corporation incorporated in the United States in a unitary relationship with the taxpayer and eligible

to be included in a federal consolidated return as described in 26 U.S.C. 1501 through 1505 that has

less than 80% of its payroll and property assigned to locations outside the United States. For

purposes of determining eligibility for inclusion in a federal consolidated return, the 80% stock

ownership requirements of 26 U.S.C. 1504 must be reduced to ownership of over 50% of the voting

stock directly or indirectly owned or controlled by a corporation in the water’s edge group.

2. Domestic international sales corporations, as described in 26 U.S.C. 991 through 994, and foreign

sales corporations, as described in 26 U.S.C. 921 through 927.

3. Export trade corporations, as described in 26 U.S.C. 970 and 971.

4. Foreign corporations deriving gain or loss from disposition of a United States real property interest to

the extent recognized under 26 U.S.C. 897.

5. A corporation incorporated outside the United States if over 50% of its voting stock is owned directly or

indirectly by the taxpayer and if less than 80% of the average of its payroll and property is assignable

to a location outside the United States.

6. A corporation that is in a unitary relationship with the taxpayer and that is incorporated in a tax haven

country. Please refer to Part IV below for additional details.

A corporation incorporated in the United States that has more than 80% of the average of its payroll and

property assignable to a location outside the United States is commonly referred to as an “80/20” company. An

80/20 company does not qualify under (1) above and, as such, is excluded from the water’s edge filing group.

The after-tax net income of United States corporations excluded from eligibility as affiliated corporations under

(1) above (80/20 companies) and possession corporations described in sections 931 through 934 and 936 of

the Internal Revenue Code are considered dividends received from corporations incorporated outside the United

States. These “deemed” dividends are calculated in Part II.

Line 1 – Positive income of 80/20 companies

Using a by-company breakdown of the federal consolidated return, enter the amount of federal line 30 for all 80/

20 companies with a positive income. Any 80/20 company reporting a loss on line 30 should be reflected as

zero in computing the 80/20 income. Enter this amount on line 1.

Line 2 – Consolidated 1120 positive income

Enter the total of federal line 30 for all companies with a positive income. Any company reporting a loss on line

30 should be reflected as zero income.

Line 3 – Ratio of 80/20 positive income to consolidated 1120 income

Divide the amount on line 1 by the amount on line 2; enter the result on line 3.

Line 4 – Tax liability as reported on consolidated 1120

Enter the federal tax liability reported on the federal consolidated Form 1120, net of any federal credits.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2