Instructions For Form Pa-20s/pa-65 - Schedule A - Interest Income

ADVERTISEMENT

20

013

Pennsylva

ania Departm

ment of Reven

nue

Inst

truction

ns for P

PA-20S

S/PA-6

5 Sche

edule A

A

Interes

t Income

e

p

production of r

rental or roya

lty

the excess

s as a loss on

PA-20S/PA-

Ge

eneral In

nformati

ion

in

ncome that th

he entity inclu

des in

65 Schedu

ule D, Part I o

r PA-20S/PA-

d

determining ne

et rent or roya

alty

65 Schedu

ule D, Part III,

, Line 13.

in

ncome;

For a li

isting of tax-e

exempt and

Pur

rpose of

f Schedu

le

taxable ob

bligations, obt

ain

●

●

Interest that

t is statutorily

y free from

Use P

PA-20S/PA-65

5 Schedule A t

to

Pennsylva

nia form REV-

-1643, Tax

P

Pennsylvania t

tax;

repor

rt interest inco

ome of PA S

Exempt Ob

bligations for

Pennsylvania

●

●

Interest deri

ved from asse

ets

corpo

orations, partn

nerships and

Personal I

ncome Tax pu

urposes.

e

employed as w

working capita

al in a

limite

ed liability com

mpanies filing

as

b

business; and

partn

nerships or PA

A S corporation

ns for

●

●

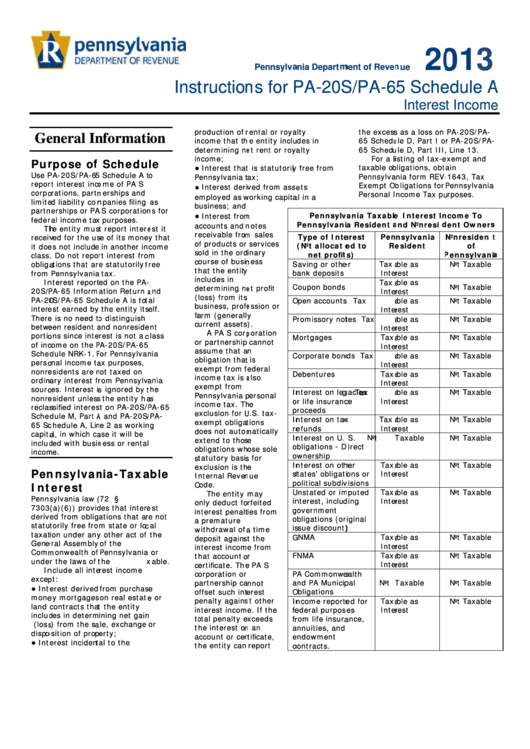

Pennsylv

vania Taxable

e Interest In

ncome To

Interest from

m

feder

ral income tax

x purposes.

Pennsylvani

a Resident a

and Nonresid

dent Owners

a

accounts and n

notes

Th

he entity mus

st report intere

est it

r

eceivable from

m sales

Type of Inte

erest

Pen

nsylvania

Nonresident

t

receiv

ved for the us

se of its mone

ey that

o

of products or

services

(Not allocate

ed to

Re

esident

of

it doe

es not include

in another in

come

s

sold in the ord

inary

net profit

ts)

P

Pennsylvania

a

class

. Do not repo

rt interest fro

m

c

course of busin

ness

obliga

ations that ar

e statutorily f

free

S

Saving or othe

er

Taxa

able as

Not Taxable

t

hat the entity

y

b

bank deposits

Inter

rest

from

Pennsylvania

tax.

in

ncludes in

In

nterest report

ed on the PA-

-

Taxa

able as

C

Coupon bonds

Not Taxable

d

determining ne

et profit

20S/

PA-65 Inform

ation Return a

and

Inter

rest

(

loss) from its

PA-20

0S/PA-65 Sch

hedule A is tot

tal

O

Open accounts

s

Taxa

able as

Not Taxable

b

business, profe

ession or

intere

est earned by

the entity its

elf.

Inter

rest

fa

arm (generall

y

There

e is no need t

o distinguish

P

Promissory not

tes

Taxa

able as

Not Taxable

c

current assets

).

betw

een resident a

and nonreside

ent

Inter

rest

A PA S corp

poration

portio

ons since inte

rest is not a c

class

M

Mortgages

Taxa

able as

Not Taxable

o

or partnership

cannot

of inc

come on the P

PA-20S/PA-65

Inter

rest

a

assume that a

n

Sche

dule NRK-1. F

For Pennsylvan

nia

C

Corporate bond

ds

Taxa

able as

Not Taxable

o

obligation that

t is

perso

onal income ta

ax purposes,

Inter

rest

e

exempt from f

federal

nonre

esidents are n

not taxed on

D

Debentures

Taxa

able as

Not Taxable

in

ncome tax is a

also

ordin

nary interest fr

rom Pennsylva

ania

Inter

rest

e

exempt from

sourc

ces. Interest is

s ignored by t

the

In

nterest on leg

gacies

Taxa

able as

Not Taxable

P

Pennsylvania p

personal

nonre

esident unless

s the entity ha

as

o

or life insuranc

ce

Inter

rest

in

ncome tax. Th

he

reclas

ssified interes

st on PA-20S/

PA-65

p

proceeds

e

exclusion for U

U.S. tax-

Sche

dule M, Part A

A and PA-20S/

/PA-

In

nterest on tax

x

Taxa

able as

Not Taxable

e

exempt obligat

tions

65 Sc

chedule A, Lin

ne 2 as workin

ng

re

efunds

Inter

rest

d

does not autom

matically

capita

al, in which ca

ase it will be

In

nterest on U.

S.

Not T

Taxable

Not Taxable

e

extend to thos

se

includ

ded with busin

ness or rental

o

obligations - D

Direct

o

obligations wh

ose sole

incom

me.

o

ownership

s

statutory basis

s for

In

nterest on oth

her

Taxa

able as

Not Taxable

e

exclusion is th

e

Pen

nnsylvan

nia-Taxa

able

st

tates’ obligati

ons or

Inter

rest

I

nternal Reven

nue

p

political subdiv

visions

C

Code.

Int

terest

U

Unstated or im

mputed

Taxa

able as

Not Taxable

The entity

may

Penn

sylvania law (

(72 P.S. §

in

nterest, includ

ding

Inter

rest

o

only deduct fo

rfeited

7303

(a)(6)) provid

des that intere

est

g

overnment

in

nterest penalt

ties from

deriv

ved from oblig

ations that ar

re not

o

obligations (or

riginal

a

a premature

statu

torily free fro

m state or loc

cal

is

ssue discount)

)

w

withdrawal of a

a time

taxat

tion under any

y other act of

the

G

GNMA

Taxa

able as

Not Taxable

d

deposit agains

st the

Gene

eral Assembly

of the

Inter

rest

in

nterest incom

e from

Comm

monwealth of

Pennsylvania

or

F

FNMA

Taxa

able as

Not Taxable

t

hat account o

r

unde

r the laws of t

the U.S. is tax

xable.

Inter

rest

c

certificate. The

e PA S

In

nclude all inte

rest income

P

PA Commonwe

ealth

c

corporation or

excep

pt:

p

partnership ca

nnot

a

nd PA Municip

pal

Not T

Taxable

Not Taxable

●

Int

erest derived

from purchas

se

O

Obligations

o

offset such inte

erest

mone

ey mortgages

on real estate

e or

p

penalty agains

st other

In

ncome reporte

ed for

Taxa

able as

Not Taxable

land

contracts that

t the entity

in

nterest incom

e. If the

fe

ederal purpos

es

Inter

rest

includ

des in determ

ining net gain

n

to

otal penalty e

exceeds

fr

rom life insura

ance,

(loss

s) from the sa

ale, exchange

or

t

he interest on

n an

a

nnuities, and

dispo

osition of prop

perty;

a

account or cer

rtificate,

e

endowment

●

Int

erest incident

tal to the

t

he entity can

report

co

ontracts.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2