Form Qctws - Contractor'S Excise Tax Return Worksheet/instructions - South Dakota Page 2

ADVERTISEMENT

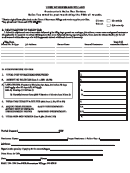

CITY/RES

CITY/RES

RATE

NET TXBL

TAX

CODE

NET TXBL

RATE

TAX

CODE

A.

G .

B.

H.

I.

C.

D.

J.

E.

K.

F.

14.

14. TOTAL CITY/RESERVATION TAX (Sum of Lines A-K)

City/Reservation taxes must be reported on purchases of construction materials, equipment, office supplies and

services used, stored or consumed within cities or reservations imposing a sales/use tax when sales tax was not

paid at the time of purchase. The individual listing of each city or reservation, its corresponding code and rate,

and net taxable amount owed for each city or reservation is listed on the original return.

15.

15. TOTAL TAX DUE

(Lines 13 + 14)

16. AMOUNT TO BE REMITTED

16.

If the amount you wish to remit is different than the Total Tax Due,

please enter the remittance amount here.

Submitting your PIN number in conjunction with a SD QUEST filed

tax return is, under state law, a valid signature.

Do not send the Department of Revenue a return or worksheet

once you have successfully filed using SD QUEST.

Please save this worksheet with your SD QUEST confirmation number.

be the only tax return record you will have.

In some cases it may

These records must be kept for at least 3 years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2