Schedule 1299-B Instructions - Illinois

ADVERTISEMENT

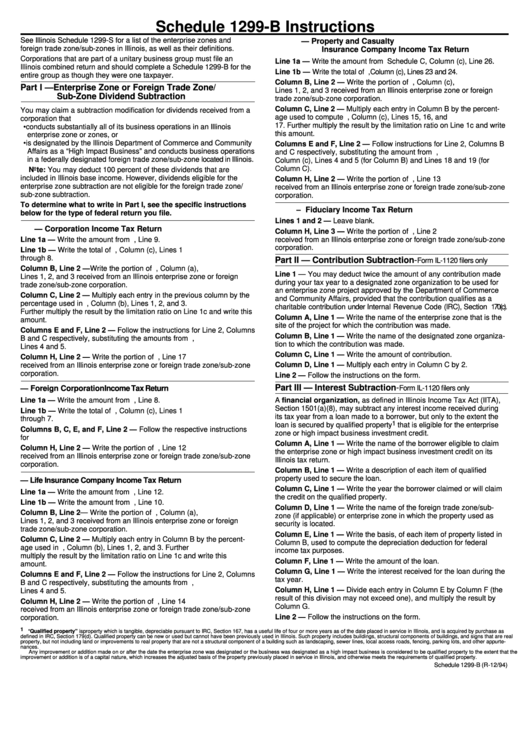

Schedule 1299-B Instructions

See Illinois Schedule 1299-S for a list of the enterprise zones and

U.S. Form 1120-PC Filers — Property and Casualty

foreign trade zone/sub-zones in Illinois, as well as their definitions.

Insurance Company Income Tax Return

Corporations that are part of a unitary business group must file an

Line 1a — Write the amount from U.S. Schedule C, Column (c), Line 26.

Illinois combined return and should complete a Schedule 1299-B for the

Line 1b — Write the total of U.S. Schedule C, Column (c), Lines 23 and 24.

entire group as though they were one taxpayer.

Column B, Line 2 — Write the portion of U.S. Schedule C, Column (c),

Part I — Enterprise Zone or Foreign Trade Zone/

Lines 1, 2, and 3 received from an Illinois enterprise zone or foreign

Sub-Zone Dividend Subtraction

trade zone/sub-zone corporation.

Column C, Line 2 — Multiply each entry in Column B by the percent-

You may claim a subtraction modification for dividends received from a

age used to compute U.S. Schedule C, Column (c), Lines 15, 16, and

corporation that

17. Further multiply the result by the limitation ratio on Line 1c and write

• conducts substantially all of its business operations in an Illinois

this amount.

enterprise zone or zones, or

• is designated by the Illinois Department of Commerce and Community

Columns E and F, Line 2 — Follow instructions for Line 2, Columns B

Affairs as a “High Impact Business” and conducts business operations

and C respectively, substituting the amount from U.S. Schedule C,

in a federally designated foreign trade zone/sub-zone located in Illinois.

Column (c), Lines 4 and 5 (for Column B) and Lines 18 and 19 (for

Column C).

Note: You may deduct 100 percent of these dividends that are

included in Illinois base income. However, dividends eligible for the

Column H, Line 2 — Write the portion of U.S. Schedule C, Line 13

enterprise zone subtraction are not eligible for the foreign trade zone/

received from an Illinois enterprise zone or foreign trade zone/sub-zone

sub-zone subtraction.

corporation.

To determine what to write in Part I, see the specific instructions

U.S. Form 1041 Filers – Fiduciary Income Tax Return

below for the type of federal return you file.

Lines 1 and 2 — Leave blank.

U.S. Form 1120 Filers — Corporation Income Tax Return

Column H, Line 3 — Write the portion of U.S. Form 1041, Line 2

Line 1a — Write the amount from U.S. Schedule C, Line 9.

received from an Illinois enterprise zone or foreign trade zone/sub-zone

corporation.

Line 1b — Write the total of U.S. Schedule C, Column (c), Lines 1

through 8.

Part II — Contribution Subtraction-

Form IL-1120 filers only

Column B, Line 2 — Write the portion of U.S. Schedule C, Column (a),

Line 1 — You may deduct twice the amount of any contribution made

Lines 1, 2, and 3 received from an Illinois enterprise zone or foreign

during your tax year to a designated zone organization to be used for

trade zone/sub-zone corporation.

an enterprise zone project approved by the Department of Commerce

Column C, Line 2 — Multiply each entry in the previous column by the

and Community Affairs, provided that the contribution qualifies as a

percentage used in U.S. Schedule C, Column (b), Lines 1, 2, and 3.

charitable contribution under Internal Revenue Code (IRC), Section 170(c).

Further multiply the result by the limitation ratio on Line 1c and write this

Column A, Line 1 — Write the name of the enterprise zone that is the

amount.

site of the project for which the contribution was made.

Columns E and F, Line 2 — Follow the instructions for Line 2, Columns

Column B, Line 1 — Write the name of the designated zone organiza-

B and C respectively, substituting the amounts from U.S. Schedule C,

tion to which the contribution was made.

Lines 4 and 5.

Column C, Line 1 — Write the amount of contribution.

Column H, Line 2 — Write the portion of U.S. Schedule C, Line 17

received from an Illinois enterprise zone or foreign trade zone/sub-zone

Column D, Line 1 — Multiply each entry in Column C by 2.

corporation.

Line 2 — Follow the instructions on the form.

Part III — Interest Subtraction-

Form IL-1120 filers only

U.S. Form 1120F Filers — Foreign Corporation Income Tax Return

Line 1a — Write the amount from U.S. Schedule C, Line 8.

A financial organization, as defined in Illinois Income Tax Act (IITA),

Section 1501(a)(8), may subtract any interest income received during

Line 1b — Write the total of U.S. Schedule C, Column (c), Lines 1

its tax year from a loan made to a borrower, but only to the extent the

through 7.

1

loan is secured by qualified property

that is eligible for the enterprise

Columns B, C, E, and F, Line 2 — Follow the respective instructions

zone or high impact business investment credit.

for U.S. Form 1120 Filers.

Column A, Line 1 — Write the name of the borrower eligible to claim

Column H, Line 2 — Write the portion of U.S. Schedule C, Line 12

the enterprise zone or high impact business investment credit on its

received from an Illinois enterprise zone or foreign trade zone/sub-zone

Illinois tax return.

corporation.

Column B, Line 1 — Write a description of each item of qualified

property used to secure the loan.

U.S. Form 1120L Filers — Life Insurance Company Income Tax Return

Column C, Line 1 — Write the year the borrower claimed or will claim

Line 1a — Write the amount from U.S. Schedule A, Line 12.

the credit on the qualified property.

Line 1b — Write the amount from U.S. Schedule A, Line 10.

Column D, Line 1 — Write the name of the foreign trade zone/sub-

Column B, Line 2 — Write the portion of U.S. Schedule A, Column (a),

zone (if applicable) or enterprise zone in which the property used as

Lines 1, 2, and 3 received from an Illinois enterprise zone or foreign

security is located.

trade zone/sub-zone corporation.

Column E, Line 1 — Write the basis, of each item of property listed in

Column C, Line 2 — Multiply each entry in Column B by the percent-

Column B, used to compute the depreciation deduction for federal

age used in U.S. Schedule A, Column (b), Lines 1, 2, and 3. Further

income tax purposes.

multiply the result by the limitation ratio on Line 1c and write this

Column F, Line 1 — Write the amount of the loan.

amount.

Column G, Line 1 — Write the interest received for the loan during the

Columns E and F, Line 2 — Follow the instructions for Line 2, Columns

tax year.

B and C respectively, substituting the amounts from U.S. Schedule A,

Column H, Line 1 — Divide each entry in Column E by Column F (the

Lines 4 and 5.

result of this division may not exceed one), and multiply the result by

Column H, Line 2 — Write the portion of U.S. Schedule A, Line 14

Column G.

received from an Illinois enterprise zone or foreign trade zone/sub-zone

Line 2 — Follow the instructions on the form.

corporation.

1 “Qualified property” is property which is tangible, depreciable pursuant to IRC, Section 167, has a useful life of four or more years as of the date placed in service in Illinois, and is acquired by purchase as

defined in IRC, Section 179(d). Qualified property can be new or used but cannot have been previously used in Illinois. Such property includes buildings, structural components of buildings, and signs that are real

property, but not including land or improvements to real property that are not a structural component of a building such as landscaping, sewer lines, local access roads, fencing, parking lots, and other appurte-

nances.

Any improvement or addition made on or after the date the enterprise zone was designated or the business was designated as a high impact business is considered to be qualified property to the extent that the

improvement or addition is of a capital nature, which increases the adjusted basis of the property previously placed in service in Illinois, and otherwise meets the requirements of qualified property.

Schedule 1299-B (R-12/94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1