Instructions For Form Ct-33.1 (2002)

ADVERTISEMENT

CT-33.1 (2002) (back)

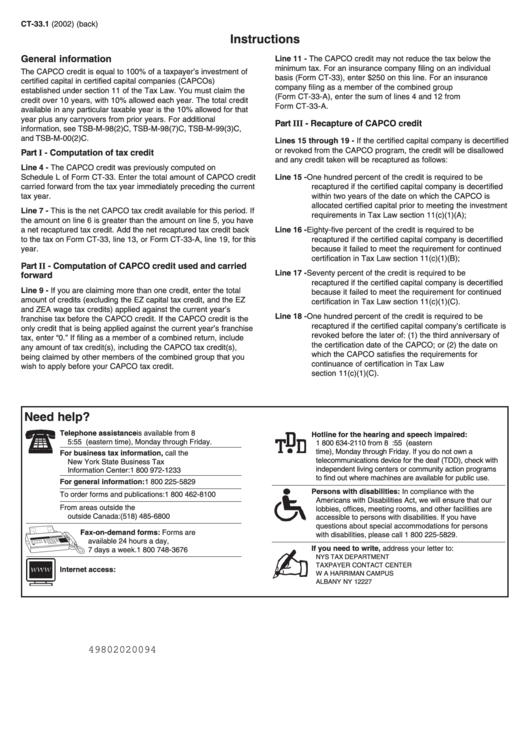

Instructions

General information

Line 11 - The CAPCO credit may not reduce the tax below the

minimum tax. For an insurance company filing on an individual

The CAPCO credit is equal to 100% of a taxpayer’s investment of

basis (Form CT-33), enter $250 on this line. For an insurance

certified capital in certified capital companies (CAPCOs)

company filing as a member of the combined group

established under section 11 of the Tax Law. You must claim the

(Form CT-33-A), enter the sum of lines 4 and 12 from

credit over 10 years, with 10% allowed each year. The total credit

Form CT-33-A.

available in any particular taxable year is the 10% allowed for that

year plus any carryovers from prior years. For additional

Part III - Recapture of CAPCO credit

information, see TSB-M-98(2)C, TSB-M-98(7)C, TSB-M-99(3)C,

and TSB-M-00(2)C.

Lines 15 through 19 - If the certified capital company is decertified

or revoked from the CAPCO program, the credit will be disallowed

Part I - Computation of tax credit

and any credit taken will be recaptured as follows:

Line 4 - The CAPCO credit was previously computed on

Schedule L of Form CT-33. Enter the total amount of CAPCO credit

Line 15 - One hundred percent of the credit is required to be

carried forward from the tax year immediately preceding the current

recaptured if the certified capital company is decertified

tax year.

within two years of the date on which the CAPCO is

allocated certified capital prior to meeting the investment

Line 7 - This is the net CAPCO tax credit available for this period. If

requirements in Tax Law section 11(c)(1)(A);

the amount on line 6 is greater than the amount on line 5, you have

a net recaptured tax credit. Add the net recaptured tax credit back

Line 16 - Eighty-five percent of the credit is required to be

to the tax on Form CT-33, line 13, or Form CT-33-A, line 19, for this

recaptured if the certified capital company is decertified

year.

because it failed to meet the requirement for continued

certification in Tax Law section 11(c)(1)(B);

Part II - Computation of CAPCO credit used and carried

Line 17 - Seventy percent of the credit is required to be

forward

recaptured if the certified capital company is decertified

Line 9 - If you are claiming more than one credit, enter the total

because it failed to meet the requirement for continued

amount of credits (excluding the EZ capital tax credit, and the EZ

certification in Tax Law section 11(c)(1)(C).

and ZEA wage tax credits) applied against the current year’s

Line 18 - One hundred percent of the credit is required to be

franchise tax before the CAPCO credit. If the CAPCO credit is the

recaptured if the certified capital company’s certificate is

only credit that is being applied against the current year’s franchise

revoked before the later of: (1) the third anniversary of

tax, enter “0.” If filing as a member of a combined return, include

the certification date of the CAPCO; or (2) the date on

any amount of tax credit(s), including the CAPCO tax credit(s),

which the CAPCO satisfies the requirements for

being claimed by other members of the combined group that you

continuance of certification in Tax Law

wish to apply before your CAPCO tax credit.

section 11(c)(1)(C).

Need help?

Telephone assistance is available from 8 a.m. to

Hotline for the hearing and speech impaired:

5:55 p.m. (eastern time), Monday through Friday.

1 800 634-2110 from 8 a.m. to 5:55 p.m. (eastern

time), Monday through Friday. If you do not own a

For business tax information, call the

telecommunications device for the deaf (TDD), check with

New York State Business Tax

independent living centers or community action programs

Information Center:

1 800 972-1233

to find out where machines are available for public use.

For general information:

1 800 225-5829

Persons with disabilities: In compliance with the

To order forms and publications:

1 800 462-8100

Americans with Disabilities Act, we will ensure that our

From areas outside the U.S. and

lobbies, offices, meeting rooms, and other facilities are

outside Canada:

(518) 485-6800

accessible to persons with disabilities. If you have

questions about special accommodations for persons

Fax-on-demand forms: Forms are

with disabilities, please call 1 800 225-5829.

available 24 hours a day,

If you need to write, address your letter to:

7 days a week.

1 800 748-3676

NYS TAX DEPARTMENT

TAXPAYER CONTACT CENTER

Internet access:

W A HARRIMAN CAMPUS

ALBANY NY 12227

49802020094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1