Instructions For Form Ct-5.1 - 2005

ADVERTISEMENT

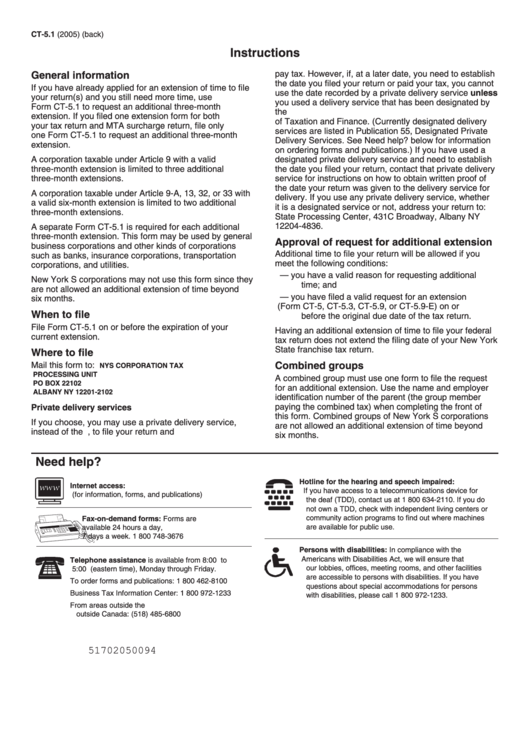

CT-5.1 (2005) (back)

Instructions

General information

pay tax. However, if, at a later date, you need to establish

the date you filed your return or paid your tax, you cannot

If you have already applied for an extension of time to file

use the date recorded by a private delivery service unless

your return(s) and you still need more time, use

you used a delivery service that has been designated by

Form CT-5.1 to request an additional three-month

the U.S. Secretary of the Treasury or the Commissioner

extension. If you filed one extension form for both

of Taxation and Finance. (Currently designated delivery

your tax return and MTA surcharge return, file only

services are listed in Publication 55, Designated Private

one Form CT-5.1 to request an additional three-month

Delivery Services. See Need help? below for information

extension.

on ordering forms and publications.) If you have used a

A corporation taxable under Article 9 with a valid

designated private delivery service and need to establish

three-month extension is limited to three additional

the date you filed your return, contact that private delivery

three-month extensions.

service for instructions on how to obtain written proof of

the date your return was given to the delivery service for

A corporation taxable under Article 9-A, 13, 32, or 33 with

delivery. If you use any private delivery service, whether

a valid six-month extension is limited to two additional

it is a designated service or not, address your return to:

three-month extensions.

State Processing Center, 431C Broadway, Albany NY

12204-4836.

A separate Form CT-5.1 is required for each additional

three-month extension. This form may be used by general

Approval of request for additional extension

business corporations and other kinds of corporations

Additional time to file your return will be allowed if you

such as banks, insurance corporations, transportation

meet the following conditions:

corporations, and utilities.

— you have a valid reason for requesting additional

New York S corporations may not use this form since they

time; and

are not allowed an additional extension of time beyond

— you have filed a valid request for an extension

six months.

(Form CT-5, CT-5.3, CT-5.9, or CT-5.9-E) on or

When to file

before the original due date of the tax return.

File Form CT-5.1 on or before the expiration of your

Having an additional extension of time to file your federal

current extension.

tax return does not extend the filing date of your New York

State franchise tax return.

Where to file

Combined groups

Mail this form to:

NYS CORPORATION TAX

PROCESSING UNIT

A combined group must use one form to file the request

PO BOX 22102

for an additional extension. Use the name and employer

ALBANY NY 12201-2102

identification number of the parent (the group member

paying the combined tax) when completing the front of

Private delivery services

this form. Combined groups of New York S corporations

If you choose, you may use a private delivery service,

are not allowed an additional extension of time beyond

instead of the U.S. Postal Service, to file your return and

six months.

Need help?

Hotline for the hearing and speech impaired:

Internet access:

If you have access to a telecommunications device for

(for information, forms, and publications)

the deaf (TDD), contact us at 1 800 634-2110. If you do

not own a TDD, check with independent living centers or

community action programs to find out where machines

Fax-on-demand forms: Forms are

are available for public use.

available 24 hours a day,

7 days a week.

1 800 748-3676

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that

Telephone assistance is available from 8:00

to

A.M.

our lobbies, offices, meeting rooms, and other facilities

5:00

(eastern time), Monday through Friday.

P.M.

are accessible to persons with disabilities. If you have

To order forms and publications:

1 800 462-8100

questions about special accommodations for persons

Business Tax Information Center:

1 800 972-1233

with disabilities, please call 1 800 972-1233.

From areas outside the U.S. and

outside Canada:

(518) 485-6800

51702050094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1