Form Mw-1 - Employer'S Return Of Tax Withheld Page 2

ADVERTISEMENT

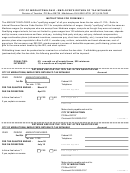

CITY OF MIDDLETOWN OHIO - EMPLOYER’S RETURN OF TAX WITHHELD

Division of Taxation PO Box 428739 Middletown OH 45042-8723 (513) 425-7862

Withholding taxes must be postmarked or received on or before the due date. If withholding payments are received

Withholding taxes must be postmarked or received on or before the due date. If withholding payments are received

after the due date, the following penalties and interest will be imposed.

after the due date, the following penalties and interest will be imposed.

LATE PAYMENT PENALTY: 50% OF THE AMOUNT NOT TIMELY PAID

LATE PAYMENT PENALTY: 50% OF THE AMOUNT NOT TIMELY PAID

LATE RETURN PENALTY: $25 PER MONTH (MAX $150)

LATE RETURN PENALTY: $25 PER MONTH (MAX $150)

2016 INTEREST RATE: 5% PER ANNUM (.42% PER MONTH)

2017 INTEREST RATE: 6% PER ANNUM (.50% PER MONTH)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7