Instructions For Tc-922a

ADVERTISEMENT

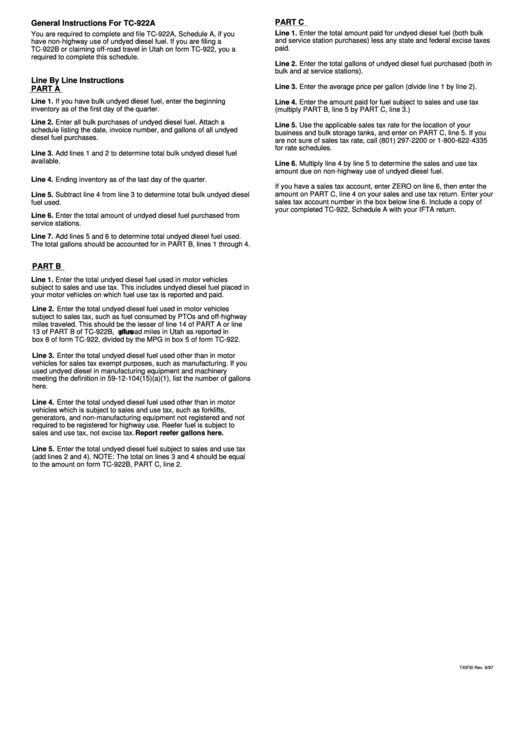

PART C

General Instructions For TC-922A

Line 1.

Enter the total amount paid for undyed diesel fuel (both bulk

You are required to complete and file TC-922A, Schedule A, if you

and service station purchases) less any state and federal excise taxes

have non-highway use of undyed diesel fuel. If you are filing a

paid.

TC-922B or claiming off-road travel in Utah on form TC-922, you a

required to complete this schedule.

Line 2.

Enter the total gallons of undyed diesel fuel purchased (both in

bulk and at service stations).

Line By Line Instructions

Line 3.

Enter the average price per gallon (divide line 1 by line 2).

PART A

Line 1.

If you have bulk undyed diesel fuel, enter the beginning

Line 4.

Enter the amount paid for fuel subject to sales and use tax

inventory as of the first day of the quarter.

(multiply PART B, line 5 by PART C, line 3.)

Line 2.

Enter all bulk purchases of undyed diesel fuel. Attach a

Line 5.

Use the applicable sales tax rate for the location of your

schedule listing the date, invoice number, and gallons of all undyed

business and bulk storage tanks, and enter on PART C, line 5. If you

diesel fuel purchases.

are not sure of sales tax rate, call (801) 297-2200 or 1-800-622-4335

for rate schedules.

Line 3.

Add lines 1 and 2 to determine total bulk undyed diesel fuel

available.

Line 6.

Multiply line 4 by line 5 to determine the sales and use tax

amount due on non-highway use of undyed diesel fuel.

Line 4.

Ending inventory as of the last day of the quarter.

If you have a sales tax account, enter ZERO on line 6, then enter the

amount on PART C, line 4 on your sales and use tax return. Enter your

Line 5.

Subtract line 4 from line 3 to determine total bulk undyed diesel

sales tax account number in the box below line 6. Include a copy of

fuel used.

your completed TC-922, Schedule A with your IFTA return.

Line 6.

Enter the total amount of undyed diesel fuel purchased from

service stations.

Line 7.

Add lines 5 and 6 to determine total undyed diesel fuel used.

The total gallons should be accounted for in PART B, lines 1 through 4.

PART B

Line 1.

Enter the total undyed diesel fuel used in motor vehicles

subject to sales and use tax. This includes undyed diesel fuel placed in

your motor vehicles on which fuel use tax is reported and paid.

Line 2.

Enter the total undyed diesel fuel used in motor vehicles

subject to sales tax, such as fuel consumed by PTOs and off-highway

miles traveled. This should be the lesser of line 14 of PART A or line

13 of PART B of TC-922B,

plus

off-road miles in Utah as reported in

box 8 of form TC-922, divided by the MPG in box 5 of form TC-922.

Line 3.

Enter the total undyed diesel fuel used other than in motor

vehicles for sales tax exempt purposes, such as manufacturing. If you

used undyed diesel in manufacturing equipment and machinery

meeting the definition in 59-12-104(15)(a)(1), list the number of gallons

here.

Line 4.

Enter the total undyed diesel fuel used other than in motor

vehicles which is subject to sales and use tax, such as forklifts,

generators, and non-manufacturing equipment not registered and not

required to be registered for highway use. Reefer fuel is subject to

sales and use tax, not excise tax.

Report reefer gallons here.

Line 5.

Enter the total undyed diesel fuel subject to sales and use tax

(add lines 2 and 4). NOTE: The total on lines 3 and 4 should be equal

to the amount on form TC-922B, PART C, line 2.

TXIFSI Rev. 9/97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1