Page 3

IF THE COMPANY DID NOT HAVE ANY RECEIPTS DURING THE PERIOD OF TIME COVERED BY THE REPORT, A STATEMENT SHOULD BE MADE ON THE REPORT SETTING FORTH WHETHER

OR NOT THE COMPANY WAS IN OPERATION DURING THE PERIOD OF TIME COVERED BY THE REPORT AND SUCH OTHER FACTS AS ACCOUNT FOR ITS FAILURE TO HAVE ANY RECEIPTS.

A.

Does this Company lease the works of any other person or corporation? (Answer: Yes or No)

If yes, list below or attach rider stating

the names of all corporations, companies, joint-stock associations, limited partnerships, co-partnerships, person or persons whose works are leased to and

operated by the Company making this report, setting forth the terms of the lease in brief, the amount of rental paid to the lessor or lessors during the period

covered by this report, and whether or not the Gross Receipts of such leased corporations, companies, joint-stock associations, limited partnerships,

co-partnerships, person or persons for the period covered by this report are included within this report.

B.

Does this company lease to any other person or corporation any part of its works? (Answer: Yes or No)

If the works of the corporation,

company, joint-stock association, limited partnership, co-partnerships, person or persons making this report are leased to and operated by another

corporation, company, joint-stock association, limited partnership, co-partnerships, person or persons, list below or attach rider stating the name of the

lessee, the terms of the lease in brief, and the amount of rental received during the period covered by this report.

Where any claim for exemption from taxation is made of any portion of the Gross Receipts during the period covered by this report, indicate the item, the

amount of exemption claimed, and basis of such claim below or attach a rider.

Attach riders to the report if more space is required.

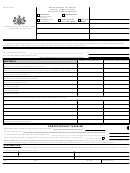

COMPUTATION BY TAXPAYER

GROSS RECEIPTS TAXABLE for the period covered by this report

$

Tax at rate of 50 mills (.050)

$

Penalty (for failure to file report within time limit prescribed by law)

$

Amount due Commonwealth. If remitting payment by Electronic Funds Transfer (EFT), place an “X” in this block

$

Mail completed tax report to the PA Department of Revenue at the address listed above. Beginning 01/01/94 payments of $20,000 or more must be remitted by EFT.

To participate in the EFT program, the Department first must receive your completed Authorization Agreement. For EFT questions only, call 1-800-892-9816.

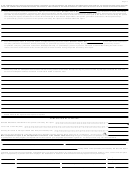

I,

of

(NAME)

(TITLE)

, hereby affirm under penalties prescribed by law that this report

(COMPANY NAME)

(including any accompanying schedules and statements), has been examined by me and to the best of my knowledge and belief is a true, correct and complete

report. If prepared by a person other than taxpayer, the declaration is based on all information of which preparer has any knowledge.

(

)

Date

Signature of Officer

Telephone Number

(

)

Date

Name of individual or Firm Preparer

Signature of Individual or Firm Preparer

Telephone Number

Street Address

City

State

Zip Code

1

1 2

2 3

3 4

4