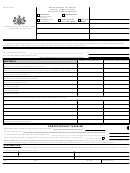

Page 2

INTRASTATE GROSS RECEIPTS

TAXABLE

EXEMPT

SUB-TOTALS BROUGHT FORWARD

$

$

12. WIDE AREA TOLL SERVICES. (Receipts derived from the transmission of communications over the

general toll switching network charged for on either a flat or measured rate basis without regard to

$

$

the number of communications; also charges for related facilities and equipment.)..................................

13. TOLL PRIVATE LINE SERVICES. (Receipts from toll private lines and facilities furnished between

points in different local service areas, providing exclusive service either continuously or during stated

periods, excepting lines leased to other wire using companies.) ..............................................................

$

$

14. TELEGRAPH COMMISSIONS. (Commissions received by the company for the billing and collecting

$

$

of telegraph, cable or wireless tolls on messages transmitted by others.)................................................

15. DIRECTORY ADVERTISING AND SALES. (Receipts derived from (a) advertising in telephone

$

$

directories and (b) sales of current directories of this company and other companies.)..........................

16. RENTS. (Receipts from the rental or subrental to others, except wire using companies, of telephone

$

$

plant constituting a part of the property used by the company in its telephone operations.)....................

17. OTHER OPERATING RECEIPTS. (Receipts derived from all miscellaneous telephone operations

$

$

not provided for elsewhere; also receipts from general services and licenses.) ......................................

18. DIVIDENDS. (Dividends received on stocks owned by the company and held in its treasury or

$

$

deposited in trust.) ...................................................................................................................................

19. INTEREST. (Interest received on funded securities of other companies owned by the company and

held in its treasury or deposited in trust; interest received on notes, bank balances and open accounts.)

$

$

20. SINKING AND RESERVE FUNDS. (Interest received on securities and other assets, other than

securities issued or assumed by the company, in the hands of trustees or specifically set aside for

$

$

sinking and other special funds.) ..............................................................................................................

21. MISCELLANEOUS PHYSICAL PROPERTY. (Receipts from miscellaneous physical property, either

owned or leased from others, used by this company for nontelephone use.) ..........................................

$

$

22. LUNCH ROOMS. (Receipts from the sale of food supplies in the employees’ lunch rooms.)...................

$

$

23. PLANT AND EQUIPMENT LEASED TO OTHERS. (Receipts derived from rental of plant and for

equipment leased to and operated by another corporation, company, joint-stock association or limited

$

$

partnership.)...............................................................................................................................................

24. ALL OTHER SOURCES. (Separately list each source below. All receipts must be shown by their

several sources. Miscellaneous receipts must be explained. If space is insufficient, attach a rider as

$

part of the report.)......................................................................................................................................

$

$

$

a. FROM

b. FROM

$

$

c. FROM

$

$

$

d. FROM

$

$

25. TOTAL GROSS RECEIPTS WITHIN THE STATE

$

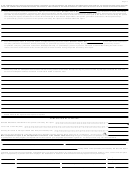

1

1 2

2 3

3 4

4