Instructions For Combined Wisconsin Individual And Fiduciary Income Tax Return For Nonresident Partners Form 1cnp 1998 Page 5

ADVERTISEMENT

Page 4

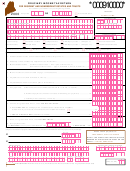

Schedule 2

If any of these differences apply, attach a schedule to

Form 1CNP showing the computation of net income.

Columns A and B. Name and Address and Identi-

ž

fying Number — Enter the information requested

Estates and trusts may be allowed certain deductions

concerning the nonresident partners who qualify and

used in computing adjusted gross income.

are participating in this combined return. Complete

names, addresses, and identifying numbers are re-

If the partner is claiming a net operating loss carry-

quired. For individuals and estates, enter the social

forward, attach a schedule showing the computation of

security number in column B. For trusts, enter the

the carryforward.

federal employer identification number. Attach a sepa-

rate schedule, if necessary.

Caution: An individual or fiduciary generally must have

a federal net operating loss in order to have a Wiscon-

Note: If both spouses are shareholders and they wish

sin net operating loss. For exceptions, see the tax

to compute their tax jointly, use only one entry line in

release titled “Wisconsin Net Operating Loss When

There Is No Federal Net Operating Loss” in Wisconsin

Schedule 2. Enter both names on that line in column A,

Tax Bulletin 70 (January 1991, page 19).

list both social security numbers in column B, and

combine their incomes in columns C, D, E, and F for

purposes of determining the tax to enter in column H.

Column D. Guaranteed Payments — Enter each

ž

partner’s guaranteed payments attributable to Wiscon-

Column C. Partner’s Share of Wisconsin Part-

sin from Schedule 3K-1, line 5, column d.

ž

nership Income (Loss) — Using the amounts entered

on Schedule 3K-1, column d, compute each partner’s

Column E. Total Wisconsin Income (Loss) — Add

ž

Wisconsin net income or loss to enter on Schedule 2,

the amounts in columns C and D for each partner.

column C. Don’t include guaranteed payments in

column C; instead, show these payments in column D.

Column F. Federal Adjusted Gross Income — For

ž

each partner who is an individual, enter the partner’s

Show income as a positive number. Show losses by

federal adjusted gross income from federal Form 1040

putting the amount in parentheses.

on Schedule 2, column F.

The net income or loss may not agree with the total of

Note: If this information is not available, you must

the amounts on Schedule 3K-1, column d, for the

compute the partner’s Wisconsin tax using the alternate

following reasons:

method described in the instructions below for Schedule

2, column H.

•

Only those separately stated deductions of the

partnership (Schedule 3K-1, lines 8 through 11 and

Column G. Filing Status — For each partner

ž

13a) that are deductible by the partners in comput-

whose federal adjusted gross income was reported in

ing federal adjusted gross income are allowed as

column F, enter the appropriate designation for the

deductions on Form 1CNP. Amounts that are

partner’s filing status in 1998: S for single, H for head of

deductible by the individual partners as itemized

a household, MFJ for married filing a joint return, and

deductions (such as charitable contributions from

MFS for married filing a separate return.

Schedule 3K-1, line 8; deductions relating to portfo-

lio income (loss) from Schedule 3K-1, line 10; and

Note: To use the joint return filing status, the partner’s

other miscellaneous itemized deductions from

spouse cannot have any income taxable by Wisconsin

Schedule 3K-1, line 11) aren’t deductible on Form

other than income or loss from this same partnership. If

1CNP. Use the Wisconsin apportionment percent-

both spouses are partners and they wish to compute

age to allocate allowable deductions to Wisconsin.

their tax jointly, combine their net incomes for purposes

of determining the tax to enter in column H.

•

Passive activity losses may be limited as provided

in the Internal Revenue Code.

Do not fill in column G for any partner whose tax must

be computed under the alternate method.

•

60% of the net capital gain realized on assets held

more than 1 year is excludable from income.

Column H. Tax — If the partner’s federal adjusted

ž

gross income has been entered on Schedule 2, column

•

The net capital loss deduction is limited to $500.

F, figure the tax on the income in column E by using the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7