Instructions For Combined Wisconsin Individual And Fiduciary Income Tax Return For Nonresident Partners Form 1cnp 1998 Page 6

ADVERTISEMENT

Page 5

tax computation worksheet for individuals below. Don’t

1998 Tax Rate Schedule —

use the tax tables in the Form WI-Z, 1A, or 1 booklets

Estates and Trusts

because a standard deduction is built into those tables.

If column E is:

The 1998 gross tax is:

No standard deduction or itemized deductions will be

over —

but not

of the

allowed for purposes of this combined filing.

over —

amount

over —

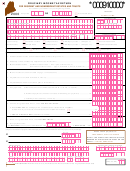

Tax Computation Worksheet — Individuals

$

0

$ 7,500

4.77%

$

0

1 If your filing status is:

7,500

15,000

$357.75 + 6.37%

7,500

• Single or head of household,

15,000 or over

$835.50 + 6.77%

15,000

fill in $7,500

• Married filing joint return,

fill in $10,000

Column I. Alternative Minimum Tax — A partner

ž

• Married filing separate return,

may be subject to the Wisconsin alternative minimum

fill in $5,000 . . . . . . . . . . . . .

tax if the partnership has adjustments and tax prefer-

2 Divide the amount from Schedule

ence items that are attributable to Wisconsin (Schedule

2, column E, by the amount from

3K-1, lines 14a through 14e, column d).

Schedule 2, column F, and enter

the ratio . . . . . . . . . . . . . . . . . . .

Complete a separate Wisconsin Schedule MT for each

3 Multiply line 1 by line 2 . . . . . . .

partner who is subject to the alternative minimum tax. If

4 Fill in the amount from Schedule

both spouses are partners and are filing a joint return,

2, column E . . . . . . . . . . . . . . . .

combine their income, adjustments, and tax preference

5 Fill in the smaller of line 3 or

items on one Schedule MT. Enter the amount of alter-

line 4 . . . . . . . . . . . . . . . . . . . . .

native minimum tax in column I. Attach a copy of

6 Multiply line 5 by 4.77% (0.0477)

(round to the nearest cent) . . .

Schedule MT to Form 1CNP.

7 Subtract line 5 from line 4. If the

result is zero, skip lines 8

Column J. Temporary Recycling Surcharge — A

ž

through 11 and go to line 12 . .

partner acting in the capacity of a partner who receives

8 Fill in the smaller of line 3 or

at least $4,000 of guaranteed payments for federal

line 7 . . . . . . . . . . . . . . . . . . . . .

income tax purposes generally is subject to the tempo-

9 Multiply line 8 by 6.37% (0.0637)

rary recycling surcharge. The surcharge is the greater

(round to the nearest cent) . . .

of $25 or 0.2173% of the guaranteed payments attribut-

10 Subtract line 8 from line 7. If the

able to Wisconsin, but not more than $9,800. The

result is zero, skip line 11 and go

surcharge doesn’t apply to a limited partner’s guaran-

to line 12 . . . . . . . . . . . . . . . . . .

teed payments for the use of capital.

11 Multiply line 10 by 6.77%

(0.0677) (round to the nearest

For additional information about the temporary recycling

cent) . . . . . . . . . . . . . . . . . . . . .

surcharge, refer to the department’s Publication 400,

12 Add lines 6, 9, and 11. Fill in the

Wisconsin’s Temporary Recycling Surcharge .

total here and on Schedule 2,

column H . . . . . . . . . . . . . . . . . .

Note: The temporary recycling surcharge is scheduled

Alternate Method: If the partner’s federal adjusted

to expire for taxable years ending on or after April 1,

gross income is unknown, multiply the Wisconsin

1999.

income in column E by 6.77% (0.0677) and enter the

result on Schedule 2, column H.

Column K. Estimated Tax Payments — Enter any

ž

estimated tax and temporary recycling surcharge pay-

For estates and trusts, use the tax rate schedule in the

ments made by the partner or by the partnership on

next column.

each partner’s behalf.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7