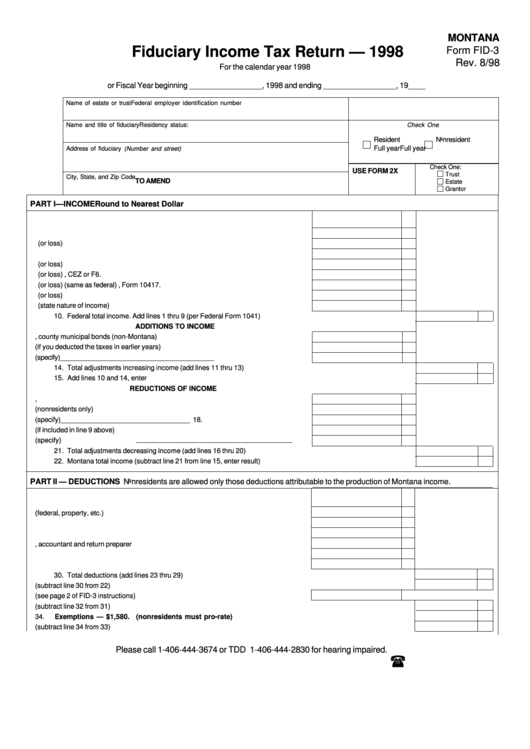

MONTANA

Fiduciary Income Tax Return — 1998

Form FID-3

Rev. 8/98

For the calendar year 1998

or Fiscal Year beginning _________________, 1998 and ending _________________, 19____

Name of estate or trust

Federal employer identification number

Name and title of fiduciary

Residency status: Check One

Resident

Nonresident

Full year

Full year

Address of fiduciary (Number and street)

Check One:

USE FORM 2X

Trust

City, State, and Zip Code

TO AMEND

Estate

Grantor

PART I—INCOME

Round to Nearest Dollar

1.

Interest income ....................................................................................................

1.

2.

Dividends ..............................................................................................................

2.

3.

Partnership income (or loss) ...................................... Attach Federal Schedule E

3.

4.

Income from another estate or trust .....................................................................

4.

5.

Net rent and royalty income (or loss) ...................................................................

5.

6.

Net business and farm income (or loss) ..Attach Federal Schedules C, CEZ or F

6.

7.

Capital gain (or loss) (same as federal) ..Attach Federal Schedule D, Form 1041

7.

8.

Ordinary gain (or loss) ................................................. Attach Federal Form 4797

8.

9.

Other income (state nature of income) .................................................................

9.

10. Federal total income. Add lines 1 thru 9 (per Federal Form 1041) .......................................................... .......

10.

ADDITIONS TO INCOME

11.

Interest on state, county municipal bonds (non-Montana) ....................................

11.

12.

Federal income tax refunds (if you deducted the taxes in earlier years) ..............

12.

13.

Other additions (specify)_________________________________________ ........

13.

14. Total adjustments increasing income (add lines 11 thru 13) ................................................................ ...........

14.

15. Add lines 10 and 14, enter result ...................................................................................................................

15.

REDUCTIONS OF INCOME

16.

Interest exclusion for U.S. savings bonds, etc. ....................................................

16.

17.

Income from sources outside Montana (nonresidents only) .................................

17.

18.

Exempt retirement income (specify)__________________________________ 18.

19.

State refund (if included in line 9 above) ...............................................................

19.

20.

Other reductions (specify) ....................................................................................

20.

21. Total adjustments decreasing income (add lines 16 thru 20) ................................................................ .........

21.

22. Montana total income (subtract line 21 from line 15, enter result) ........................................................ ..........

22.

PART II — DEDUCTIONS Nonresidents are allowed only those deductions attributable to the production of Montana income.

23.

Interest .................................................................................................................

23.

24.

Taxes (federal, property, etc.) ...............................................................................

24.

25.

Charitable contributions .......................................................................................

25.

26.

Fiduciary fees and administrative expenses .........................................................

26.

27.

Attorney, accountant and return preparer fees .....................................................

27.

28.

Casualty or theft losses .......................................................................................

28.

29.

Other deductions. Attach a separate sheet listing deductions ............................

29.

30. Total deductions (add lines 23 thru 29) ..........................................................................................................

30.

31.

Total (subtract line 30 from 22) ..............................................................................................................................

31.

32.

Income distribution deduction (see page 2 of FID-3 instructions) .........................

32.

33.

Net income before exemption (subtract line 32 from 31) .......................................................................................

33.

34.

Exemptions — $1,580.

(nonresidents must pro-rate)..........................................................................

34.

35.

Taxable income of fiduciary (subtract line 34 from 33) ..................................................................... .....................

35.

Please call 1-406-444-3674 or TDD 1-406-444-2830 for hearing impaired.

1

1 2

2