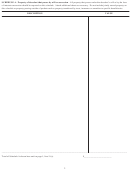

ALLOCATION AND COMPUTATION SCHEDULE FOR THE ESTATE OF ______________________ DOD _________________

(See instructions on page 8)

Beneficiary’ s Name and Address

Age

Relationship

Amount Assigned

Tax

(1)

(2)

(3)

(4)

(5)

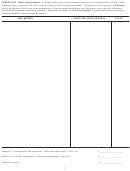

12. Total Amount Assigned (add column 4 of Allocation & Computation Schedule)............................ $ ________________

13. Inheritance Tax Imposed (add column 5 of Allocation & Computation Schedule)..................................................................... $ ________________

14. South Dakota Estate Tax

(a) Residents...................................................................................................................................................................... $ ________________

(b) Non-Residents............................................................................................................................................................. $ ________________

15. Estimated Tax Due (Line 13, 14(a) or 14(b)), whichever is GREATER..................................................................................... $ ________________

16. Interest Payable

(a) Death on or before July 1, 1983 = 6%/year from DOD.............................................................................................. $ ________________

(b) Death after July 1, 1983 - 1 1/2%/month from one year after DOD.......................................................................... $ ________________

(c) Death after July 1, 1991 - (Category B as established by SDCL 54-3-16 from one year after DOD) 12%............... $ ________________

(d) Death after July 1, 1994 - (Category B as established by SDCL 54-3-16 from one year after DOD) 10%............... $ ________________

17. Inheritance Tax or Estate Tax and Interest Due........................................................................................................................... $ ________________

18. Total Amount of Tax Previously Paid or Estimated Payment..................................................................................................... $ _______________

19. Balance Due.................................................................................................................................................................................. $ _______________

20. Refund Amount Claimed.............................................................................................................................................................. $ _______________

6

1

1 2

2 3

3 4

4 5

5 6

6