Instructions For Form Nyc-9.7b - 1999

ADVERTISEMENT

Form NYC-9.7B - 1999

Page 2

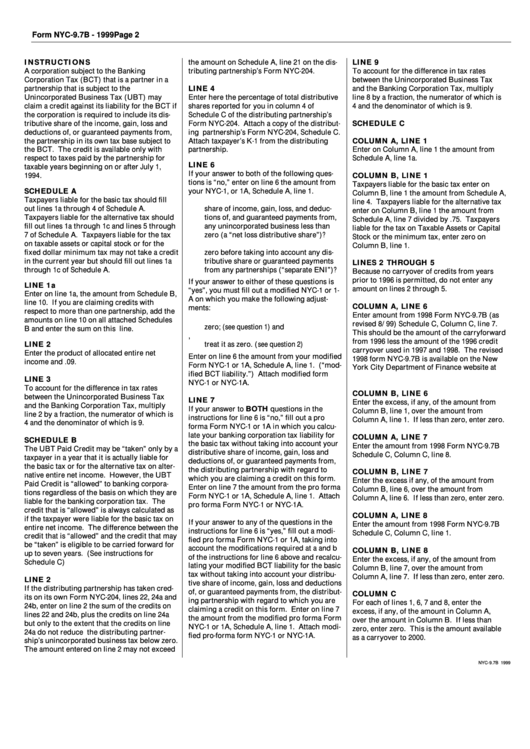

INSTRUCTIONS

the amount on Schedule A, line 21 on the dis-

LINE 9

A corporation subject to the Banking

tributing partnership’s Form NYC-204.

To account for the difference in tax rates

Corporation Tax (BCT) that is a partner in a

between the Unincorporated Business Tax

partnership that is subject to the

LINE 4

and the Banking Corporation Tax, multiply

Unincorporated Business Tax (UBT) may

Enter here the percentage of total distributive

line 8 by a fraction, the numerator of which is

claim a credit against its liability for the BCT if

shares reported for you in column 4 of

4 and the denominator of which is 9.

the corporation is required to include its dis-

Schedule C of the distributing partnership’s

tributive share of the income, gain, loss and

Form NYC-204. Attach a copy of the distribut-

SCHEDULE C

deductions of, or guaranteed payments from,

ing partnership’s Form NYC-204, Schedule C.

the partnership in its own tax base subject to

Attach taxpayer’s K-1 from the distributing

COLUMN A, LINE 1

the BCT. The credit is available only with

partnership.

Enter on Column A, line 1 the amount from

respect to taxes paid by the partnership for

Schedule A, line 1a.

LINE 6

taxable years beginning on or after July 1,

If your answer to both of the following ques-

1994.

COLUMN B, LINE 1

tions is “no,” enter on line 6 the amount from

Taxpayers liable for the basic tax enter on

SCHEDULE A

your NYC-1, or 1A, Schedule A, line 1.

Column B, line 1 the amount from Schedule A,

Taxpayers liable for the basic tax should fill

1.

Was the sum of your net distributive

line 4. Taxpayers liable for the alternative tax

out lines 1a through 4 of Schedule A.

share of income, gain, loss, and deduc-

enter on Column B, line 1 the amount from

Taxpayers liable for the alternative tax should

tions of, and guaranteed payments from,

Schedule A, line 7 divided by .75. Taxpayers

fill out lines 1a through 1c and lines 5 through

any unincorporated business less than

liable for the tax on Taxable Assets or Capital

7 of Schedule A. Taxpayers liable for the tax

zero (a “net loss distributive share”)?

Stock or the minimum tax, enter zero on

on taxable assets or capital stock or for the

2.

Was your entire net income less than

Column B, line 1.

fixed dollar minimum tax may not take a credit

zero before taking into account any dis-

in the current year but should fill out lines 1a

tributive share or guaranteed payments

LINES 2 THROUGH 5

through 1c of Schedule A.

from any partnerships (“separate ENI”)?

Because no carryover of credits from years

prior to 1996 is permitted, do not enter any

If your answer to either of these questions is

LINE 1a

amount on lines 2 through 5.

“yes”, you must fill out a modified NYC-1 or 1-

Enter on line 1a, the amount from Schedule B,

A on which you make the following adjust-

line 10. If you are claiming credits with

COLUMN A, LINE 6

ments:

respect to more than one partnership, add the

Enter amount from 1998 Form NYC-9.7B (as

a.

treat all net loss distributive shares as

amounts on line 10 on all attached Schedules

revised 8/99) Schedule C, Column C, line 7.

zero; (see question 1) and

B and enter the sum on this line.

This should be the amount of the carryforward

b.

if your separate ENI is less than zero,

from 1996 less the amount of the 1996 credit

treat it as zero. (see question 2)

LINE 2

carryover used in 1997 and 1998. The revised

Enter the product of allocated entire net

Enter on line 6 the amount from your modified

1998 form NYC-9.7B is available on the New

income and .09.

Form NYC-1 or 1A, Schedule A, line 1. (“mod-

York City Department of Finance website at

ified BCT liability.”) Attach modified form

LINE 3

NYC-1 or NYC-1A.

To account for the difference in tax rates

COLUMN B, LINE 6

between the Unincorporated Business Tax

LINE 7

Enter the excess, if any, of the amount from

and the Banking Corporation Tax, multiply

If your answer to BOTH questions in the

Column B, line 1, over the amount from

line 2 by a fraction, the numerator of which is

instructions for line 6 is “no,” fill out a pro

Column A, line 1. If less than zero, enter zero.

4 and the denominator of which is 9.

forma Form NYC-1 or 1A in which you calcu-

late your banking corporation tax liability for

COLUMN A, LINE 7

SCHEDULE B

the basic tax without taking into account your

Enter the amount from 1998 Form NYC-9.7B

The UBT Paid Credit may be “taken” only by a

distributive share of income, gain, loss and

Schedule C, Column C, line 8.

taxpayer in a year that it is actually liable for

deductions of, or guaranteed payments from,

the basic tax or for the alternative tax on alter-

the distributing partnership with regard to

COLUMN B, LINE 7

native entire net income. However, the UBT

which you are claiming a credit on this form.

Enter the excess if any, of the amount from

Paid Credit is “allowed” to banking corpora-

Enter on line 7 the amount from the pro forma

Column B, line 6, over the amount from

tions regardless of the basis on which they are

Form NYC-1 or 1A, Schedule A, line 1. Attach

Column A, line 6. If less than zero, enter zero.

liable for the banking corporation tax. The

pro forma Form NYC-1 or NYC-1A.

credit that is “allowed” is always calculated as

COLUMN A, LINE 8

if the taxpayer were liable for the basic tax on

If your answer to any of the questions in the

Enter the amount from 1998 Form NYC-9.7B

entire net income. The difference between the

instructions for line 6 is “yes,” fill out a modi-

Schedule C, Column C, line 1.

credit that is “allowed” and the credit that may

fied pro forma Form NYC-1 or 1A, taking into

be “taken” is eligible to be carried forward for

account the modifications required at a and b

COLUMN B, LINE 8

up to seven years. (See instructions for

of the instructions for line 6 above and recalcu-

Enter the excess, if any, of the amount from

Schedule C)

lating your modified BCT liability for the basic

Column B, line 7, over the amount from

tax without taking into account your distribu-

Column A, line 7. If less than zero, enter zero.

LINE 2

tive share of income, gain, loss and deductions

If the distributing partnership has taken cred-

of, or guaranteed payments from, the distribut-

COLUMN C

its on its own Form NYC-204, lines 22, 24a and

ing partnership with regard to which you are

For each of lines 1, 6, 7 and 8, enter the

24b, enter on line 2 the sum of the credits on

claiming a credit on this form. Enter on line 7

excess, if any, of the amount in Column A,

lines 22 and 24b, plus the credits on line 24a

the amount from the modified pro forma Form

over the amount in Column B. If less than

but only to the extent that the credits on line

NYC-1 or 1A, Schedule A, line 1. Attach modi-

zero, enter zero. This is the amount available

24a do not reduce the distributing partner-

fied pro-forma form NYC-1 or NYC-1A.

as a carryover to 2000.

ship’s unincorporated business tax below zero.

The amount entered on line 2 may not exceed

NYC-9.7B 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1