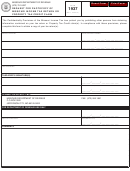

Form 54-002a - Property Tax Credit Claim - Iowa Department Of Revenue Page 2

ADVERTISEMENT

Owners who live in the homestead may file a claim on

government assistance. (See instructions 18b).

their portion. Enter the prorated gross property tax on

Line 12: Social Security Income - Enter the total

line J. Example: There are three owners of a home,

Social Security benefits received even if not reportable

but only two reside there. The gross property taxes

for income tax purposes. Include any Medicare

equal $1,800. The prorated amount to be entered on

premiums withheld.

line J is $1,200, because $1,800 ÷ 3 = $600. There

are two owners living in the homestead, so multiply

Line 13: Disability - Enter the total received for

$600 x 2 = $1,200. Do not prorate the homestead

disability or injury compensation, even if not reportable

credit.

for income tax purposes.

Line 7: Mark “Yes” if part of your homestead building

Line 14: All pensions and annuities - Enter the total

was rented or used for business purposes during

received from pensions and annuities, even if not

1998. If you marked “Yes,” you are entitled to a credit

reportable for income tax purposes.

of property tax due on only that portion of the

Line 15: Interest and Dividend income - Enter

homestead building utilized as the dwelling place by

taxable interest income. Include all interest income

yourself, spouse and household members.

from federal, state and municipal securities, even if not

The percentage of property tax that is allowable for a

reportable for income tax purposes.

credit is calculated by determining the square footage

Enter taxable dividends and distributions received.

of that portion of the homestead building utilized as

Include cash dividends and dividends paid in the form

the personal dwelling by yourself, spouse and

of merchandise or other property and report at fair

household members in relation to the square footage

market value.

of the entire homestead building. Enter this

percentage in the space provided. Example: personal

Line 16: Profit from business and/or farming and

square footage used = 750, total square footage =

capital gains - Enter 1998 profit from business and/or

1000. The percentage = 75%. (Figured: 750/1000 =

farming, and any gains received from the sale or

.75) This percentage is to be used in computing the

exchange of capital assets. Capital losses are limited

amount to enter on Line J.

to the same amount that you are allowed to report for

income tax purposes. Any loss must be offset

Line 8: Mark “Yes” if part of the land in your

against gains, and a net loss must be reported as

homestead is rented or rented on shares; complete

zero.

"Schedule For Rented Homestead Tracts", Side 2,

lines A through I.

Line 17: Monetary contributions - Enter money

received from others living with you in 1998. Do not

1998 HOUSEHOLD INCOME

include goods and services received.

CALCULATION FOR SIDE 1

Line 18: Other income - Enter total income received

from the following sources:

Household income includes the income of the

claimant, the claimant ’s spouse and monetary

(a) Child support and alimony payments.

contributions received from any other person living

(b) Welfare payments. Do not include non-

with the claimant.

cash government assistance (food,

If you received a property tax credit in 1998, do not

clothing, food stamps, medical supplies,

report this as income.

etc.)

Line 9: Wages, salaries, tips, etc. - Enter the total

(c) Insurance income not reported elsewhere.

wages, salaries, tips, bonuses, and commissions

(d) Other income not reported on lines 9

received.

through 17.

Line 10: In-kind Assistance - Enter any portion of

Line 19: Total household income - Add lines 9

your housing expenses including utilities that were

through 18. Enter total here.

paid for you. Do not enter Federal Energy Assistance.

This claim must be filed with your County

Line 11: Title 19 Benefits - Enter your Title 19

Treasurer by June 1, 1999.

benefits received for housing. If you live in a nursing

The treasurer may extend the filing deadline

home or care facility, contact the administrator for the

to September 30, 1999, or, the Director of

amount to enter. You may wish to just enter 20% for

Revenue and Finance may extend the filing

living in the nursing home, or 40% for living in a care

deadline to December 31, 2000.

facility. Do not include medical benefits or non-cash

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2