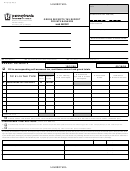

Instructions For Rct-123 - Gross Premiums Tax - Surplus Lines Agents - Pennsylvania Department Of Revenue Page 2

ADVERTISEMENT

minimum of $500, regardless of the

Electronic Payment

electronic method to make a payment

determined

tax

liability,

plus

an

Enter “Y” in the block on Page 1 if the

with an extension request should not

taxpayer has made any electronic pay-

additional 1 percent of any determined

submit the extension coupon. Do not

ments using e-TIDES.

tax liability over $25,000.

use the extension coupon to remit other

•

unpaid liabilities within the account.

Final Report

Address Change

Enter “Y” in the block on Page 1 if

Enter “Y” in the block on Page 1 if the

Payment and Mailing Information

this report will be the final report

address of the corporation has changed

All payments of $1,000 or more must be

filed with the department. Indicate

from prior tax periods. The current

made electronically or by certified or

the effective date of the event as

mailing address should be reflected on

cashier’s check remitted in person or by

MMDDYYYY.

•

the report.

express mail courier. Failure to make a

payment by an approved method will

Include information from the Penn-

Correspondence to Preparer

sylvania Insurance Department

result in the imposition of a 3 percent

Enter “Y” in the block on Page 1 if all

verifying the taxpayer’s insurance

penalty of the tax due, up to $500. For

correspondence (notices and requests

license expired, was cancelled or

more information on electronic payment

for additional information) is to be sent

not renewed.

•

options, visit

to the preparer’s address. If “Y” is

Payments under $1,000 may be remit-

entered, the address recorded on Page

Include a copy of the regulatory

ted by mail, made payable to the PA

2 will be used.

authority’s approval of the merger,

Department of Revenue.

dissolution, plan of reorganization

Amended Report

and/or articles of merger.

•

Mail payments, extension requests and

Enter “Y” in the block if you are filing an

Tax Report, RCT-123 to the following

amended report to add, delete or adjust

Provide the Revenue ID and FEIN of

the surviving entity, if applicable.

address:

information. Provide documentation to

support all changes being made. An

Corporate Officer Information

PA DEPARTMENT OF REVENUE

amended report should only be filed if

A corporate officer must sign and date

327 WALNUT ST FL 3

an original report was filed previously

the tax report. The signature must be

PO BOX 280407

for the same period.

original; photocopies or faxes will not be

HARRISBURG PA 17128-2005

accepted. Print the first and last name,

An amended report must be filed within

Current Period Overpayment

title, Social Security number, telephone

three years of the filed date of the

If an overpayment exists on Page 1 of

number and email address of the corpo-

original report. The department may

the RCT-123, the taxpayer must instruct

rate officer.

adjust the tax originally reported based

the department to refund or transfer

on information from the amended

Preparer’s Information

overpayment as indicated below.

report. The taxpayer must consent to

Paid preparers must sign and date the

extend the assessment period. If the

Refund: Identify the amount to refund

tax report. If the preparer works for a

amended report is timely filed and the

firm, provide the name, FEIN and

from the current tax period overpay-

taxpayer consented to extend the

address of the firm along with the

ment. Prior to any refund, the depart-

assessment period, the time period in

name, telephone number, email address

ment will offset current period liabilities

which to assess tax will be the greater

and PTIN/SSN of the individual prepar-

and other unpaid liabilities within the

of three years from the filed date of the

ing the report. If the preparer is an

account.

individual without any association to a

original report or one year from the filed

Transfer: Identify the amount to

firm, provide the name, address,

date of the amended report.

transfer from the current tax period

telephone number, email address and

Regardless of the tax year being

overpayment to the next tax period.

PTIN/SSN of the individual preparing

amended, taxpayers must use the most

Prior to any transfer, the department

the report.

current non-year-specific tax form,

will offset current period liabilities and

Extension Request Due Date

completing all sections of the report.

other unpaid liabilities within the

To request a due date extension of up

This includes those sections originally

account.

to 60 days to file the annual report, you

filed and those sections being amended.

must file an extension request, REV-

NOTE: If no option is selected,

All tax liabilities should be recorded on

426, by the original report due date.

the department will automatically

Page 1. Taxpayers must check the

However, an extension of time to file

transfer any overpayment to the next

Amended Report check box on Page 1

does not extend the deadline for pay-

tax year after offsetting current period

and include Schedule AR, REV-1175,

ment of tax, and an extension request

liabilities and other unpaid liabilities

with the report.

must be accompanied by payment of

within the account.

First Report

taxes owed for the taxable year for

Enter “Y” in the block on Page 1 if this

A tax period overpayment summary will

which the extension is requested. Mail

is the taxpayer’s first PA gross

be mailed to the taxpayer confirming

the extension coupon separately from

premiums tax filing.

all other forms. A taxpayer using an

the disposition of the credit.

RCT-123

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4