Instructions For Rct-123 - Gross Premiums Tax - Surplus Lines Agents - Pennsylvania Department Of Revenue Page 3

ADVERTISEMENT

Requests for Refund or Transfer of

Total Gross Premiums - Enter the

LINE INSTRUCTIONS

Available Credit

total yearly gross premiums for each

Requests for refund or transfer of avail-

branch.

This

total

MUST

include

RCT-123 should be completed in

returned and/or exempt premiums;

able credit from prior periods can be

the following order:

these adjustments are made in the next

faxed on company letterhead, signed

(Page instructions start with Page 3

two columns.

by an authorized representative, to

below.)

717-705-6227.

Step 1 - Complete the taxpayer infor-

Less Total Returned Premiums -

mation section and any applicable

Enter the total returned premiums for

Requests can also be submitted in writ-

questions at the top of Page 1.

each branch.

ing to the following address:

Step 2 - Enter the Revenue ID and other

Less Tax Exempt Premiums - Enter

PA DEPARTMENT OF REVENUE

taxpayer information in the designated

the total exempt premiums for each

PO BOX 280701

fields at the top of each page.

branch.

HARRISBURG PA 17128-0701

Step 3 - Complete Page 3, Schedule B,

Gross Premiums Taxable - Enter the

Please do not duplicate requests for re-

Branch Offices.

difference of total gross premiums less

fund and/or transfer by submitting both

returned premiums less tax exempt

RCT-123 and written correspondence.

Step 4 - Complete Page 2, Schedule A,

premiums for each branch. Taxable

Taxable Premiums.

CONTACT INFORMATION

•

gross premiums cannot be less than

Step 5 - Complete the Calculation of

zero.

To make electronic payments and

Tax at the top of Page 2.

file extensions electronically, visit e-

Grand Totals - Enter the sum of all

TIDES at

Step 6 - Complete Page 1, Lines 1

gross premiums taxable. This figure

For additional information and as-

through 10.

must reconcile to the total as reported

sistance with electronic payments

on Page 2, Schedule A.

Step 7 - Complete the corporate officer

and extensions call 717-705-6225

information section, sign and date at

Tax Amount - Multiply the gross

(Option 6).

•

the bottom of Page 1.

premiums taxable column by 0.03.

To confirm account payments, call

Step 8 - Complete the preparer

Grand Totals - Enter the sum of all tax

1-888-PATAXES (1-888-728-2937).

•

information section, sign and date at

amounts. This figure must reconcile to

the bottom of Page 2, if applicable.

If you have questions regarding

the total as reported on Page 2, Line 2.

payments or refunds, call the Ac-

Step 9 - Mail the completed report and

Location of Risk - Enter the location(s)

counting Division at 717-705-6225

any supporting schedules to the PA

the risk will cover.

(Option 5, then Option 1).

•

Department of Revenue.

NOTE: If the policy involves risk

Requests for transfer of credit may

Step 10 - File a signed copy of all three

located in multiple states includ-

be faxed to the Accounting Division

pages of the RCT-123 tax report and the

ing Pennsylvania, the taxable premium

at 717-705-6227.

•

monthly 1620 reports electronically with

shall be levied as follows:

the PA Surplus Lines Association in the

If you have questions regarding ex-

If Pennsylvania is the home state of the

Electronic Filing System (EFS).

tensions, call the Extension Unit at

insured, the gross premiums shall be

717-705-6225 (Option 4). Requests

PAGE 3

taxable to Pennsylvania. For more

can be faxed to 717-705-6227.

•

information see 40 P.S. § 991.1602, 40

If you have questions regarding tax

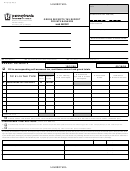

SChEDULE B - BRANCh OFFICE

P.S. § 991.1621 and 40 P.S. §

assessments, determinations or fil-

991.1622.

Complete Schedule B if the producer

ing requirements, call the Specialty

has multiple branch offices filing under

Tax Unit at 717-783-6031 (Option

PAGE 2

the same FEIN.

7, then Option 2).

•

NOTE: You are required to file a

CALCULATION OF TAxABLE GROSS

If you have general business tax

copy of each monthly 1620 report

PREMIUMS

questions, call 717-787-1064.

•

for each branch office that is reported

Schedule A - Taxable Premiums

If you have questions regarding

on this schedule.

filing a copy of this return electron-

Monthly Premiums

Customer Number - Enter the number

ically with the Pennsylvania Surplus

Enter the taxable premiums as reported on

assigned by the Pennsylvania Surplus

Lines Association, call the Pennsyl-

the monthly 1620 reports for each of the

Lines Association for each branch.

vania Surplus Lines Association at

12 months. If there are multiple branches,

610-594-1340 or visit their website

Address - Enter the address of each

this will be the sum of all monthly 1620

at

branch office.

reports for the respective month.

RCT-123

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4