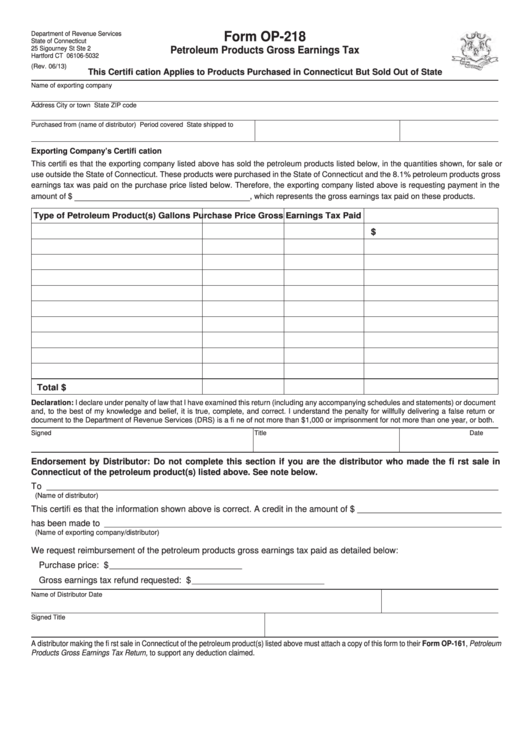

Department of Revenue Services

Form OP-218

State of Connecticut

25 Sigourney St Ste 2

Petroleum Products Gross Earnings Tax

Hartford CT 06106-5032

(Rev. 06/13)

This Certifi cation Applies to Products Purchased in Connecticut But Sold Out of State

Name of exporting company

Address

City or town

State

ZIP code

Purchased from (name of distributor)

Period covered

State shipped to

Exporting Company’s Certifi cation

This certifi es that the exporting company listed above has sold the petroleum products listed below, in the quantities shown, for sale or

use outside the State of Connecticut. These products were purchased in the State of Connecticut and the 8.1% petroleum products gross

earnings tax was paid on the purchase price listed below. Therefore, the exporting company listed above is requesting payment in the

amount of $ ________________________________________ , which represents the gross earnings tax paid on these products.

Type of Petroleum Product(s)

Gallons

Purchase Price

Gross Earnings Tax Paid

$

Total

$

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) or document

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or

document to the Department of Revenue Services (DRS) is a fi ne of not more than $1,000 or imprisonment for not more than one year, or both.

Signed

Title

Date

Endorsement by Distributor: Do not complete this section if you are the distributor who made the fi rst sale in

Connecticut of the petroleum product(s) listed above. See note below.

To

____________________________________________________________________________________________________________________

(Name of distributor)

This certifi es that the information shown above is correct. A credit in the amount of $

_____________________________________

has been made to

______________________________________________________________________________________________________

(Name of exporting company/distributor)

We request reimbursement of the petroleum products gross earnings tax paid as detailed below:

Purchase price: ..........................................$

__________________________________

Gross earnings tax refund requested: ........$

__________________________________

Name of Distributor

Date

Signed

Title

A distributor making the fi rst sale in Connecticut of the petroleum product(s) listed above must attach a copy of this form to their Form OP-161, Petroleum

Products Gross Earnings Tax Return, to support any deduction claimed.

1

1