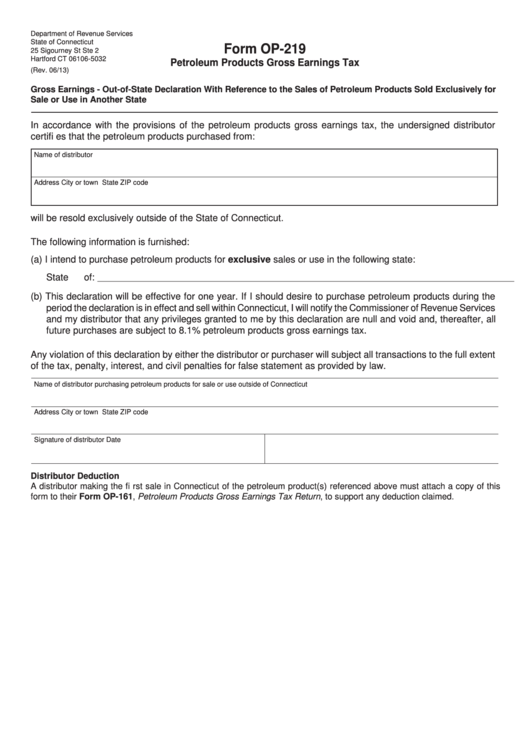

Form Op-219 - Petroleum Products Gross Earnings Tax

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

Form OP-219

25 Sigourney St Ste 2

Hartford CT 06106-5032

Petroleum Products Gross Earnings Tax

(Rev. 06/13)

Gross Earnings - Out-of-State Declaration With Reference to the Sales of Petroleum Products Sold Exclusively for

Sale or Use in Another State

In accordance with the provisions of the petroleum products gross earnings tax, the undersigned distributor

certifi es that the petroleum products purchased from:

Name of distributor

Address

City or town

State

ZIP code

will be resold exclusively outside of the State of Connecticut.

The following information is furnished:

(a) I intend to purchase petroleum products for exclusive sales or use in the following state:

State of:

___________________________________________________________________________________________________________

(b) This declaration will be effective for one year. If I should desire to purchase petroleum products during the

period the declaration is in effect and sell within Connecticut, I will notify the Commissioner of Revenue Services

and my distributor that any privileges granted to me by this declaration are null and void and, thereafter, all

future purchases are subject to 8.1% petroleum products gross earnings tax.

Any violation of this declaration by either the distributor or purchaser will subject all transactions to the full extent

of the tax, penalty, interest, and civil penalties for false statement as provided by law.

Name of distributor purchasing petroleum products for sale or use outside of Connecticut

Address

City or town

State

ZIP code

Signature of distributor

Date

Distributor Deduction

A distributor making the fi rst sale in Connecticut of the petroleum product(s) referenced above must attach a copy of this

form to their Form OP-161, Petroleum Products Gross Earnings Tax Return, to support any deduction claimed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1