Property Tax Reimbursement Instructions - New Jersey Division Of Taxation Page 14

ADVERTISEMENT

A.

If your father met the other eligibility requirements, he is entitled to a property tax

reimbursement because he is considered to be a homeowner. He must obtain from

his facility’s management a statement as to the amount of property taxes due and

paid that were attributable to the residential unit he occupied, and enclose a copy

of this statement with your Form PTR-1 application.

37.

Q.

1997 is my base year, and I satisfied all the eligibility requirements for 1997

and 1998. However, I appealed my 1997 property tax assessment and was

just notified that the assessment was reduced and I received a partial refund

of my 1997 property taxes. I already filed my Property Tax Reimbursement

Application. How do I amend my application?

A.

In order to amend a Property Tax Reimbursement Application you should file a new

application with the corrected information and write “amended” across the top. If

you are filing an amended application to reduce your base year property taxes be

sure to attach proof of the reduction.

38.

Q.

1997 is my base year, and I satisfied all the eligibility requirements for 1997

and 1998. However, I appealed my 1998 property tax assessment. I have

already received my 1998 property tax reimbursement but I was just notified

that my 1998 assessment was reduced and I received a partial refund of my

1998 property taxes. What should I do?

A.

Anytime that the amount of your property taxes is increased or decreased you are

required to notify the Division of Taxation of the change by filing an amended

application if the change affects either your base year or a year for which you have

claimed a property tax reimbursement. If the change results in an increase in the

amount of a reimbursement you have already received the Division of Taxation will

send you a check for the difference. If the change results in a decrease in the

amount of a reimbursement you have already received you will be required to

repay the difference to the Division. For information on how to file an amended

return, see the answer to Question 37, above.

39.

Q.

Is the property tax reimbursement taxable income for New Jersey gross

income tax purposes?

A.

No. The property tax reimbursement is not taxable income and should not be

included on Form NJ-1040.

40.

Q.

The amounts I paid for local services, such as water, sewer, or trash removal

are separately stated on my property tax bill. May I use these amounts to

determine my property tax reimbursement?

PTR FAQ – 10

1/00

ADVERTISEMENT

0 votes

Related Articles

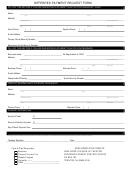

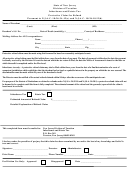

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16