Property Tax Reimbursement Instructions - New Jersey Division Of Taxation Page 9

ADVERTISEMENT

♦ Benefits received as New Jersey State Homestead Rebates

♦ Capital gains on the sale of a principal residence after May 6, 1997 of up to

$250,000 if single, and up to $500,000 if married. Capital gains in excess of the

allowable exclusion must be included in income. (Capital gains and the

exclusion of all or part of the gain on the sale of a principal residence are

computed in the same manner for both federal and State income tax purposes.)

♦ Stipends from the Volunteers in Service to America (VISTA) and Foster

Grandparents programs

♦ Proceeds received from a spouse’s life insurance policy

♦ Agent Orange Payments

♦ Reparation payments to Japanese Americans by the Federal Government

pursuant to sections 105 and 106 of the Civil Liberties Act of 1988, P.L.

100-383 (50 U.S.C. App. 1989b-4 and 1989b-5)

18.

Q.

Since my property taxes were “frozen” at the 1997 level, I only paid my local

tax collector that amount in 1998, even though my property tax bill was for

more than the 1997 amount. Am I entitled to the reimbursement?

A.

No. In order to be eligible for the reimbursement you must have paid the full

amount of property taxes that were due for both your base year and the year for

which you are claiming the reimbursement.

19.

Q.

How will you know what the amount of my property taxes was, and whether I

paid the full amount?

A.

When you file your property tax reimbursement application you must enclose proof

of the amount of your property tax bill for the base year and the current year, as

well as proof of the amount of taxes that were paid. You can do this by sending

copies of your property tax bills and copies of cancelled checks or receipts. If you

do not provide the necessary proof with your application you will not receive a

reimbursement.

20.

Q.

What if I can’t find my cancelled checks or my property tax bill?

A.

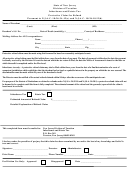

In the property tax reimbursement application packet we have included a verifica-

tion form, Form PTR-1A, which you may take to your local tax collector and ask

them to fill out for you. When completed, the form will show the amount of property

taxes that were due and paid on your home for the base year and the year for

which you are claiming the reimbursement. The Division will only accept the form if

the tax collector places his or her official stamp on it. Mobile home owners may

have Form PTR-1B (on the reverse of the homeowner’s form, PTR-1A) completed

1/00

PTR FAQ – 5

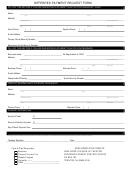

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16