Property Tax Reimbursement Instructions - New Jersey Division Of Taxation Page 3

ADVERTISEMENT

PROPERTY TAX REIMBURSEMENT

Frequently Asked Questions

1999 UPDATE

The Property Tax Reimbursement Program reimburses eligible senior citizens and disabled

persons for property tax increases. The amount of the reimbursement is the difference between

the amount of property taxes paid in the year the applicant became eligible for the program (the

“base year”) and the amount of property taxes paid for the current year.

For 1998, the first year of the program, applicants who had met the income and residency

requirements and who had paid the full of amount of their property taxes for 1997 and 1998

received reimbursement checks representing the difference between the amount of the property

taxes paid in 1997 and the amount paid in 1998, provided the amount of property taxes paid in

1998 was greater than the amount paid in 1997.

Who is eligible for a 1999 Property Tax Reimbursement?

Applicants eligible to receive a 1999 Property Tax Reimbursement are those who:

• Were age 65 or older or receiving Federal Social Security disability benefits as of

December 31, 1998 (if disabled, continued to receive benefits through December 31,

1999); and

• Owned and lived in the home (or mobile home which is on a leased site in a mobile

home park) since before January 1, 1996; and

• Lived in New Jersey continuously since before January 1, 1989, as either a homeowner

or a tenant; and

• Had total annual income for 1998 of less than $17,918, if single, or combined income

less than $21,970, if married; and

• Had total annual income for 1999 of less than $18,151 if single, or combined income

less than $22,256 if married; and

• Paid the full amount of property taxes (or site fee if a mobile home owner) due for both

1998 and 1999.

How do you claim a 1999 Property Tax Reimbursement?

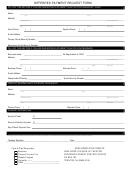

There are two different versions of the 1999 Property Tax Reimbursement Application. Form

PTR-1 is to be used by applicants who did not receive a 1998 Property Tax Reimbursement.

Applicants must provide income and property tax information for both 1998 and 1999 when

completing Form PTR-1.

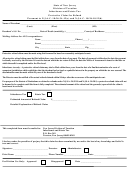

Form PTR-2 is to be used by applicants who applied for and received a 1998 Property Tax

Reimbursement. Form PTR-2 is a personalized application which is preprinted with some of the

information provided for 1998. Second year filers will only have to provide their 1999 income and

property tax information on Form PTR-2. Anyone who received a 1998 reimbursement check

and who has not received their personalized application may call the Property Tax Reimburse-

ment Hotline (1-800-882-6597) to have one mailed to them.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16