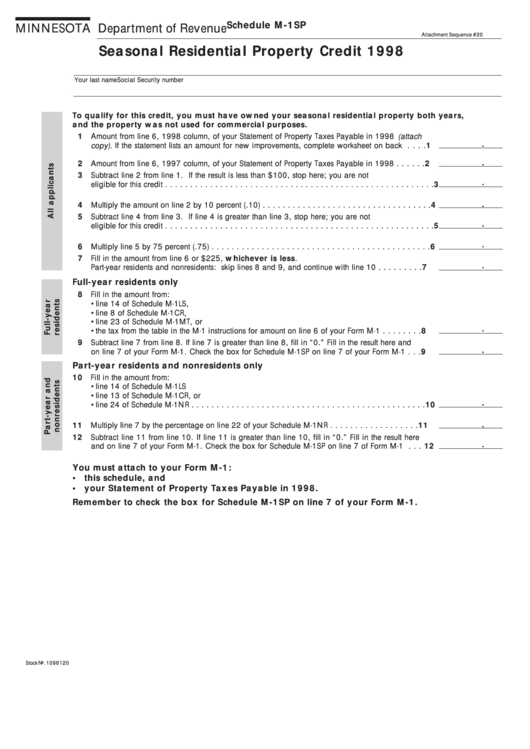

Schedule M-1SP

MINNESOTA Department of Revenue

Attachment Sequence #20

Seasonal Residential Property Credit 1998

Your last name

Social Security number

To qualify for this credit, you must have owned your seasonal residential property both years,

and the property was not used for commercial purposes.

1 Amount from line 6, 1998 column, of your Statement of Property Taxes Payable in 1998 (attach

.

copy). If the statement lists an amount for new improvements, complete worksheet on back . . . . 1

.

2 Amount from line 6, 1997 column, of your Statement of Property Taxes Payable in 1998 . . . . . . 2

3 Subtract line 2 from line 1. If the result is less than $100, stop here; you are not

.

eligible for this credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

4 Multiply the amount on line 2 by 10 percent (.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. If line 4 is greater than line 3, stop here; you are not

.

eligible for this credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.

6 Multiply line 5 by 75 percent (.75) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Fill in the amount from line 6 or $225, whichever is less.

.

Part-year residents and nonresidents: skip lines 8 and 9, and continue with line 10 . . . . . . . . . 7

Full-year residents only

8 Fill in the amount from:

• line 14 of Schedule M-1LS,

• line 8 of Schedule M-1CR,

• line 23 of Schedule M-1MT, or

.

• the tax from the table in the M-1 instructions for amount on line 6 of your Form M-1 . . . . . . . . 8

9 Subtract line 7 from line 8. If line 7 is greater than line 8, fill in “0.” Fill in the result here and

.

on line 7 of your Form M-1. Check the box for Schedule M-1SP on line 7 of your Form M-1 . . . 9

Part-year residents and nonresidents only

10 Fill in the amount from:

• line 14 of Schedule M-1LS

• line 13 of Schedule M-1CR, or

.

• line 24 of Schedule M-1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

11 Multiply line 7 by the percentage on line 22 of your Schedule M-1NR . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 10. If line 11 is greater than line 10, fill in “0.” Fill in the result here

.

and on line 7 of your Form M-1. Check the box for Schedule M-1SP on line 7 of Form M-1 . . . 12

You must attach to your Form M-1:

• this schedule, and

• your Statement of Property Taxes Payable in 1998.

Remember to check the box for Schedule M-1SP on line 7 of your Form M-1.

Stock No. 1098120

1

1