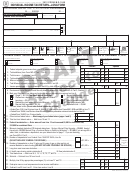

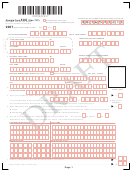

Georgia Form 500 Draft - Individual Income Tax Return Page 2

ADVERTISEMENT

500

YOUR SOCIAL SECURITY NUMBER

Georgia Form

Individual Income Tax Return

Georgia Department of Revenue

2007

If amount on line 8, 9, 10, 13 or 15 is negative, fill in circle. Example:

,

,

,

.

00

8.

8. Federal adjst. gross income

...

(From Federal Form 1040,1040A or 1040 EZ)

(Do not use FEDERAL TAXABLE INCOME)

If the amount on Line 8 is $40,000 or more, or your gross income is less than your W-2s, you must enclose a copy of your

Federal Form 1040 Pages 1 and 2. Do not enclose other Federal Schedules

,

,

,

.

00

9.

9. Adjustments from Schedule 1 (see Tax Booklet on Page 7, Line 9).....

,

,

.

,

00

10. Georgia adjusted gross income (Net total of Line 8 and Line 9)..........

10.

,

,

.

,

00

11. Standard Deduction

(Do not use FEDERAL STANDARD DEDUCTION)

.

11a.

See Tax Booklet on Page 8 Line 11

b.

Self: 65 or over?

Blind?

Spouse: 65 or over?

Blind?

,

,

,

.

00

=

............

11b.

Total x 1,300

,

,

,

.

00

c.Total Standard Deduction (Line 11a + Line 11b)..............................

11c.

Use EITHER Line 11c OR Line 12c (Do not write on both lines)

12.

Total Itemized Deductions used in computing Federal Taxable Income. If you use itemized deductions, you must enclose Federal Schedule A

,

,

,

.

00

a. Itemized Deductions (Schedule A-Form 1040) ...............................

12a.

,

,

.

,

00

b. Less adjustments: seeTax Booklet on Page 8, Line 12

..................

12b.

,

,

,

.

00

12c.

,

,

,

.

00

13. Subtract either Line 11c or Line 12c from Line 10; enter balance.

......

13.

,

.

00

14a. Number on Line 6c_multiplied by $2,700 14a.

,

.

00

14b. Number on Line 7a_multiplied by $3,000 14b.

,

,

,

.

00

14c. Add Lines 14a. and 14b. Enter total....................................................

14c.

,

,

,

.

00

15. Georgia taxable income (Line 13 less Line 14c or Schd. 3, Line 14)..

15.

,

,

,

.

00

16. Tax (Use Tax Table in the Tax Booklet on Pages 17-19)......................

16.

,

,

,

.

17. Credits from Schedule 2, Page 3, Line 7

00

Enter total but not more than the amount on Line 16).........................

17.

(

,

,

.

,

00

18. Balance (Line 16 less Line 17) if zero or less than zero, enter zero....

18.

,

,

,

.

1

9. Georgia Income Tax Withheld

00

(Enter Tax Withheld Only and enclose W-2s, 1099s, etc..............................

19.

,

,

,

.

00

20. Estimated Tax for 2007 and Form IT-560 .......................................

20.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7