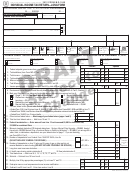

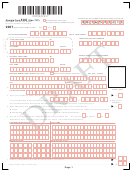

Georgia Form 500 Draft - Individual Income Tax Return Page 4

ADVERTISEMENT

500

Georgia Form

Individual Income Tax Return

Georgia Department of Revenue

2007

YOUR SOCIAL SECURITY NUMBER

SCHEDULE 1 ADJUSTMENTS to INCOME BASED on GEORGIA LAW

(see Tax Booklet on Pages7 and 8)

ADDITIONS to INCOME

,

,

.

,

00

1. Interest on Non-Georgia Municipal and State Bonds......................................

1.

,

,

,

.

00

2. Lump Sum Distribution....................................................................................

2.

,

,

,

.

00

3. Federal deduction for income attributable to domestic production activities.......

3.

(IRC Section 199)

.

,

,

,

00

4. Other (specify)

.

,

,

,

00

5. Total Additions (enter sum of Lines 1-4 here)

SUBTRACTION from INCOME

6. Retirement Income Exclusion (see Tax Booklet on Page 12)

a. Self: Date of Birth

Date of Disability:

Type of Disability:

,

.

00

6a.

Type of Disability:

Date of Disability:

b. Spouse: Date of Birth

,

.

00

6b.

,

,

,

.

00

7. Social Security Benefits (Taxable portion from Federal return).......................7.

,

,

.

,

00

8. Georgia Higher Education Savings Plan.........................................................8.

,

,

.

,

00

9. Interest on United States Obligations (See Tax Booklet on Page 7) ...............9.

10. Other Adjustments (specify)

Adjustment

Amount

Adjustment

Amount

Adjustment

Amount

Adjustment

Amount

,

,

,

.

00

Total...................................10.

,

,

,

.

00

11. Total Subtractions (enter sum of Lines 6-10 here)........................................11.

,

,

,

.

12. Net Adjustments (Line 5 less Line 11.

00

Enter Net Total here and on Line 9 of Page 1)(+ or -)..................................12.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7