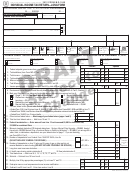

Georgia Form 500 Draft - Individual Income Tax Return Page 5

ADVERTISEMENT

500

YOUR SOCIAL SECURITY NUMBER

Georgia Form

Individual Income Tax Return

Georgia Department of Revenue

2007

SCHEDULE 2 CREDITS for LINE 17, PAGE 2

(see Tax Booklet on Page 8)

,

,

,

.

00

1. Other State(s) Tax Credit (see Tax Booklet on Page 11) ..........................................

1.

,

,

,

.

00

2.

2. Low and Zero Emission Vehicle Credit .....................................................................

3.

Credits from Form IND-CR (Rural Physicians Credit, Disabled Person Home Purchase or

Retrofit Credit, Driver Education Credit, Disaster Assistance Credit, Qualified Caregiving

Expense Credit, Georgia National Guard/Air National Guard Credit, Child and

,

,

,

.

00

Dependent Care Expense Credit and Conservation Credit ..........................................

3.

Pass Through Credits from Ownership of Sole Proprietor, S Corp., LLC or Partnership Interest

You must list the appropriate Credit Type Code in the space provided. List the percentage of credit received in the % column. If you claim more

than two credits, enclose a schedule. Enter the schedule total on Line 6. See Tax Booklet on Page 24 for a list of available credits and their

applicable codes.

4.

CREDIT TYPE CODE

COMPANY NAME

CREDIT CLAIMED ON THIS RETURN

FEIN

%

,

,

,

.

00

COMPANY NAME

5.

CREDIT TYPE CODE

FEIN

%

CREDIT CLAIMED ON THIS RETURN

,

,

.

,

00

,

,

,

.

00

6.

Enter the total from enclosed schedule (s)...........................................................6.

,

,

.

,

00

7.

Enter the total of Lines 1-6 here and on Line 17, Page 2.....................................7.

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7