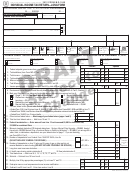

Georgia Form 500 Draft - Individual Income Tax Return Page 6

ADVERTISEMENT

YOUR SOCIAL SECURITY NUMBER

500

SCHEDULE 3 COMPUTATION OF GEORGIA TAXABLE INCOME FOR ONLY PART-YEAR

Georgia Form

RESIDENTS AND NONRESIDENTS (CONTINUED ON PAGE 7)

Individual Income Tax Return

Georgia Department of Revenue

Income earned in another state as a Georgia resident is taxable but other state(s)

2007

tax credit may apply. See TaxBooklet, Page 8, Line 17 and Page 11

DO NOT USE LINES 9 THRU 14 OF PAGES 1 AND 2, FORM 500

FEDERAL INCOME AFTER GEORGIA ADJUSTMENT

COLUMN A

,

.

INCOME

,

00

1. Wages, Salaries, Tips,.....................................................................................

1.

.

,

,

00

2. Interest and Dividends......................................................................................

2.

.

,

,

00

3. Business Income or (Loss)...............................................................................

3.

,

,

.

00

4. Other Income or (Loss) ........... ........................................................................

4.

.

,

,

00

5. Total Income:Total Lines 1 thru 4 .....................................................................

5.

ADJUSTMENTS TO INCOME

,

,

.

00

6. Totaladjustments form Form 1040...................................................................

6.

,

.

,

00

7. Total adjsutmentsfrom Form 500, Schedule 1, Page 3...................................

7.

(See Tax Booklet, Page 7-8, Line 9)

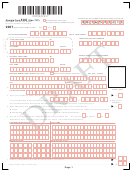

INCOME NOT TAXABLE TO GEORGIA

COLUMN B

INCOME

.

,

,

00

1. Wages, Salaries, Tips,.....................................................................................

1.

.

,

,

00

2. Interest and Dividends......................................................................................

2.

,

,

.

00

3. Business Income or (Loss)...............................................................................

3.

.

,

,

00

4. Other Income or (Loss).....................................................................................

4.

.

,

,

00

5. Total Income:Total Lines 1 thru 4......................................................................

5.

ADJUSTMENTS TO INCOME

,

.

,

00

6. Totaladjustments form Form 1040....................................................................

6.

.

,

,

00

7. Total adjsutmentsfrom Form 500, Schedule 1, Page 3....................................

7.

(See Tax Booklet, Page 7-8, Line 9)

GEORGIA INCOME

COLUMN C

.

INCOME

,

,

00

1. Wages, Salaries, Tips,.....................................................................................

1.

,

,

.

00

2. Interest and Dividends.....................................................................................

2.

.

,

,

00

3. Business Income or (Loss).............................................................................

3.

.

,

,

00

4. Other Income or (Loss)...................................................................................

4.

.

,

,

00

5. Total Income:Total Lines 1 thru 4.....................................................................

5.

ADJUSTMENTS TO INCOME

.

,

,

00

6. Total adjustments form Form 1040.................................................................

6.

.

,

,

00

7. Total adjsutmentsfrom Form 500, Schedule 1, Page 3..................................

7.

(See Tax Booklet, Page 7-8, Line 9)

Page 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7