Instructions For Schedule Q (Form 5300) - Elective Determination Requests

ADVERTISEMENT

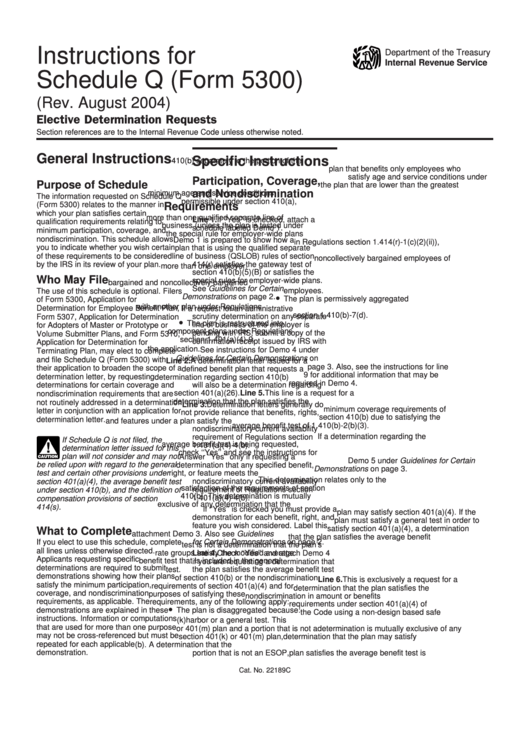

Instructions for

Department of the Treasury

Internal Revenue Service

Schedule Q (Form 5300)

(Rev. August 2004)

Elective Determination Requests

Section references are to the Internal Revenue Code unless otherwise noted.

3. The employer applies section

General Instructions

Specific Instructions

410(b) separately to the portion of the

plan that benefits only employees who

satisfy age and service conditions under

Participation, Coverage,

Purpose of Schedule

the plan that are lower than the greatest

and Nondiscrimination

minimum age and service conditions

The information requested on Schedule Q

permissible under section 410(a),

(Form 5300) relates to the manner in

Requirements

4. The plan benefits employees of

which your plan satisfies certain

more than one qualified separate line of

Line 1. If ‘‘Yes’’ is checked, attach a

qualification requirements relating to

business (unless the plan is tested under

schedule labeled Demo 1.

minimum participation, coverage, and

the special rule for employer-wide plans

nondiscrimination. This schedule allows

Demo 1 is prepared to show how a

in Regulations section 1.414(r)-1(c)(2)(ii)),

you to indicate whether you wish certain

plan that is using the qualified separate

5. The plan benefits the

of these requirements to be considered

line of business (QSLOB) rules of section

noncollectively bargained employees of

414(r) satisfies the gateway test of

by the IRS in its review of your plan.

more than one employer.

section 410(b)(5)(B) or satisfies the

6. The plan benefits both collectively

Who May File

special rules for employer-wide plans.

bargained and noncollectively bargained

See Guidelines for Certain

employees.

The use of this schedule is optional. Filers

•

Demonstrations on page 2.

The plan is permissively aggregated

of Form 5300, Application for

with another plan under Regulations

Determination for Employee Benefit Plan,

If a request for an administrative

section 1.410(b)-7(d).

Form 5307, Application for Determination

scrutiny determination on any separate

•

The plan is restructured into

line of business of the employer is

for Adopters of Master or Prototype or

component plans under Regulations

pending with IRS, submit a copy of the

Volume Submitter Plans, and Form 5310,

section 1.401(a)(4)-9.

confirmation receipt issued by IRS with

Application for Determination for

the application.

See instructions for Demo 4 under

Terminating Plan, may elect to complete

Guidelines for Certain Demonstrations on

and file Schedule Q (Form 5300) with

Line 2. A determination letter issued for a

page 3. Also, see the instructions for line

their application to broaden the scope of a

defined benefit plan that requests a

9 for additional information that may be

determination letter, by requesting

determination regarding section 410(b)

required in Demo 4.

will also be a determination regarding

determinations for certain coverage and

section 401(a)(26).

Line 5. This line is a request for a

nondiscrimination requirements that are

determination that the plan satisfies the

not routinely addressed in a determination

Line 3. Determination letters generally do

minimum coverage requirements of

letter in conjunction with an application for

not provide reliance that benefits, rights,

section 410(b) due to satisfying the

determination letter.

and features under a plan satisfy the

average benefit test of 1.410(b)-2(b)(3).

nondiscriminatory current availability

If a determination regarding the

requirement of Regulations section

If Schedule Q is not filed, the

average benefit test is being requested,

1.401(a)(4)-4(b).

!

determination letter issued for this

check ‘‘Yes’’ and see the instructions for

plan will not consider and may not

Answer ‘‘Yes’’ only if requesting a

CAUTION

Demo 5 under Guidelines for Certain

be relied upon with regard to the general

determination that any specified benefit,

Demonstrations on page 3.

test and certain other provisions under

right, or feature meets the

This determination relates only to the

nondiscriminatory current availability

section 401(a)(4), the average benefit test

satisfaction of the requirements of section

requirement of Regulations section

under section 410(b), and the definition of

410(b). This determination is mutually

1.401(a)(4)-4(b).

compensation provisions of section

exclusive of any determination that the

414(s).

If ‘‘Yes’’ is checked you must provide a

plan may satisfy section 401(a)(4). If the

demonstration for each benefit, right, and

plan must satisfy a general test in order to

feature you wish considered. Label this

satisfy section 401(a)(4), a determination

What to Complete

attachment Demo 3. Also see Guidelines

that the plan satisfies the average benefit

for Certain Demonstrations on page 2.

If you elect to use this schedule, complete

test is not a determination that the plan’s

all lines unless otherwise directed.

rate groups satisfy the modified average

Line 4. Check ‘‘Yes’’ and attach Demo 4

Applicants requesting specific

benefit test that is included in the general

if you are requesting a determination that

determinations are required to submit

the plan satisfies the average benefit test

test.

demonstrations showing how their plans

of section 410(b) or the nondiscrimination

Line 6. This is exclusively a request for a

satisfy the minimum participation,

requirements of section 401(a)(4) and for

determination that the plan satisfies the

coverage, and nondiscrimination

purposes of satisfying these

nondiscrimination in amount or benefits

requirements, as applicable. The

requirements, any of the following apply:

requirements under section 401(a)(4) of

•

demonstrations are explained in these

The plan is disaggregated because:

the Code using a non-design based safe

instructions. Information or computations

1. The plan includes a section 401(k)

harbor or a general test. This

that are used for more than one purpose

or 401(m) plan and a portion that is not a

determination is mutually exclusive of any

may not be cross-referenced but must be

section 401(k) or 401(m) plan,

determination that the plan may satisfy

repeated for each applicable

2. The plan includes an ESOP and a

section 410(b). A determination that the

demonstration.

portion that is not an ESOP,

plan satisfies the average benefit test is

Cat. No. 22189C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5