page 5

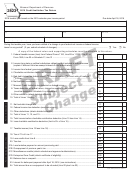

TAXABLE YEAR

ACCOUNT NO.

NAME OF CORPORATION

Schedule J - COMPUTATION OF NET EARNINGS SUBJECT TO TAX

Combined Federal Net Income is computed by combining income and expenses before the net operating loss deduction and special deductions shown on the federal returns

of each of the members of the unitary group of financial institutions (Dividends, receipts, and expenses from transactions between members of the filing group are

eliminated on lines 2 and 3 of Schedule J).

A unitary Group includes those entities engaged in the business activities or operations of a financial institution that are of mutual benefit, dependent upon or contributing

to one another individually or as a group, in transacting the business of a financial institution.

Complete Lines 1-4 only if you are a financial institution filing a combined unitary return. Non-unitary taxpayers filing separately start their computations at Line 5.

1. Combined federal net earnings (see instructions above) .................................................................................................................. (1) __________________

2. Add expenses from transactions between members of the unitary group ......................................................................................... (2) __________________

3. Deduct dividends and receipts from transactions between members of the unitary group ................................................................ (3) __________________

4. Net income for unitary group financial institutions ......................................................................................................................... (4) __________________

5. Net income (Fed. Form 1120 before NOL deduction and special deductions or "ordinary income" per 1120-S. Combined filers

leave blank) .................................................................................................................................................................................... (5)

6. Income items to extent includable in federal income, were it not for "S" status election .......................... (6) ___________________

7. Tennessee Excise Tax (to the extent deducted on Fed. Form 1120 or 1120-S) ........................................ (7) ___________________

8. Interest on obligations of States and their political subdivisions ............................................................... (8) ___________________

9. Depletion not based on actual recovery of cost ........................................................................................ (9) ___________________

10. Contribution carryover from prior period(s) .......................................................................................... (10) ___________________

11. Capital gains offset capital loss carryover .............................................................................................. (11) ___________________

12. Excess fair market value over book value of property donated .............................................................. (12) ___________________

13. Any expense or depreciation deducted for federal tax purpose solely as a result of "safe harbor" lease

election(s) ............................................................................................................................................. (13) ___________________

14. TOTAL additions ......................................................................................................................................................................... (14) __________________

15. Expense items to extent includable in federal expenses, were it not for "S" status election .................... (15) ___________________

16. Dividends of subsidiary, at least 80% owned ........................................................................................ (16) ___________________

17. Contributions in excess of amount allowed by federal government ....................................................... (17) ___________________

18. Portion of capital loss not included in federal taxable income ................................................................ (18) ___________________

19. Nonbusiness earnings (From Schedule M, Line 8) ................................................................................ (19) ___________________

20. Any expense, other than income taxes, not deducted in determining federal taxable income for

which a credit against the federal income tax is allowable ..................................................................... (20) ___________________

21. Any income included for federal tax purposes solely as a result of "safe harbor" lease election(s) ......... (21) ___________________

22. Any depreciation or other expense which could have been deducted for federal tax purposes had

it not been for "safe harbor" lease election(s) ........................................................................................ (22) ___________________

23. Bad debts not deducted but allowed by I.R.C. 585 or 593 as it existed on 12-31-86 .............................. (23) ___________________

(

)

24. TOTAL deductions ....................................................................................................................................................................... (24) __________________

25. Taxable income (if loss, complete Schedule K) (Line 4 or 5 plus Line 14 minus Line 24) ............................................................ (25) __________________

26. Ratio (Schedule SE) if applicable or 100% ................................................................................................................................... (26) __________________

%

27. Line 25 multiplied by Line 26 ....................................................................................................................................................... (27) __________________

28. Add: Non business earnings allocated directly to Tennessee (From Schedule M, Line 9) ............................................................. (28) __________________

(

)

29. Deduct: Loss carryover from prior years ...................................................................................................................................... (29) __________________

30. Subject to tax rate of 6% (enter here and on Schedule B, Line 9) .................................................................................................. (30) __________________

Schedule K - DETERMINATION OF LOSS CARRYOVER AVAILABLE -See Item 1320-6-.21 Rule and Regulations

(

)

1. Net loss from Line 25 ............................................................................................................................. (1) ___________________

2. Add: Income deducted at Line 16 and 19 ............................................................................................... (2) ___________________

(

)

3. Reduced loss (if Line 2 equals or exceeds Line 1, show "0") .................................................................. (3) ___________________

%

4. Excise Tax ratio (Schedule SE if applicable or 100%) ............................................................................. (4) ___________________

(

)

5. Current year loss carryover available (Line 3 multiplied by Line 4) ................................................................................................. (5) __________________

Schedule L - SCHEDULE OF ESTIMATED PAYMENTS AND CREDITS

1. Franchise Tax extension payment and prior year's overpayment .............................................................. (1) ___________________

2. Franchise Tax jobs credit (From Schedule X) ......................................................................................... (2) ___________________

3. Franchise Tax Day Care credit (From Schedule W) ................................................................................ (3) ___________________

4. Total Franchise Tax payments/credits (Add Lines 1 through 3; transfer to Schedule A, Line 4) .............. (4) ___________________

5. Excise Tax extension and estimated payments and prior year's overpayment .......................................... (5) ___________________

6. Excise Tax credit on industrial machinery (From Schedule T) ................................................................ (6) ___________________

7. Excise Tax Day Care credit (From Schedule W) ..................................................................................... (7) ___________________

8. Total excise tax payments/credits (Add Lines 5 through 7; transfer to Schedule B, Line 12) ........................................................... (8) __________________

INTERNET (02-98)

1

1 2

2 3

3 4

4 5

5