Irs Publication 555 - Community Property Page 12

ADVERTISEMENT

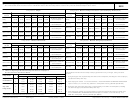

Example

next) is prepared to figure their federal income tax both

ways. Walter and Mary must claim their own exemptions

Walter and Mary Smith are married and domiciled in a

on their separate returns.

community property state. Their two children (18-year-old

The summary at the bottom of the worksheet compares

twins) and Mary’s mother live with them and qualify as their

the tax figured on the Smiths’ joint return to the total tax

dependents. Amounts paid for their support were paid out

figured by adding the tax amounts on their separate re-

of community funds.

turns. By filing separately under the community property

Walter received a salary of $65,424. Income tax with-

laws of their state, the Smiths save $289 in income tax.

held from his salary was $6,356. Walter received $132 in

If the Smiths were domiciled in Idaho, Louisiana, Texas,

taxable interest from his savings account. He also received

or Wisconsin, the result would be slightly different because

$217 in dividends from stock that he owned. His interest

in those states income from separate property generally is

and dividend income are his separate income under the

treated as community income. If they lived in one of those

laws of his community property state.

states, the interest from Walter’s savings account and the

Mary received $200 in dividends from stock that she

dividends from stock owned by each of them would be

owned. This is her separate income. In addition, she re-

divided equally on their separate returns.

ceived $13,400 as a part-time dental technician. Income

In figuring your tax, use the amounts from your

tax withheld from her salary was $1,352.

!

current tax forms instruction booklet for items

The Smiths paid a total of $7,775 in medical expenses.

such as the standard deduction, exemption allow-

CAUTION

Medical insurance of $2,050 was paid out of community

ance, and Tax Table tax. The amounts used in this exam-

funds. Walter paid $5,725 out of his separate funds for an

ple apply for 2011 only. The example shows how filing

operation he had.

separate returns under community property tax laws can

The Smiths had $10,264 in other itemized deductions,

result in lower tax than filing jointly; you must figure your

none of which were miscellaneous itemized deductions

own tax both ways to know which works better for you.

subject to the 2%-of-adjusted-gross-income limit. The

amounts spent for these deductions were paid out of com-

munity funds.

To see if it is to the Smiths’ advantage to file a joint

return or separate returns, a worksheet (Table 3, shown

Page 12

Publication 555 (March 2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17