Irs Publication 555 - Community Property Page 13

ADVERTISEMENT

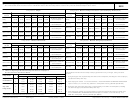

Table 3. Worksheet — Walter and Mary Smith

Separate Returns

Joint Return

Walter’s

Mary’s

Income (Walter’s):

Salary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 65,424

$ 32,712

$ 32,712

Interest and dividends ($217 dividends + $132 interest)

349

349

– 0 –

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 65,773

$ 33,061

$ 32,712

Income (Mary’s):

Salary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 13,400

$ 6,700

$ 6,700

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

200

– 0 –

200

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13,600

6,700

6,900

Adjusted gross income (AGI) . . . . . . . . . . . . . . . . . . . . . .

$ 79,373

$ 39,761

$ 39,612

Deductions:

Community: (Not subject to the 2% AGI limit) . . . . . . . .

$ 10,264

$ 5,132

$ 5,132

Medical:

Premiums . . . . . . . . . . . . . . . . . . . . . . . . .

$

2,050

$ 1,025

$ 1,025

Medical expenses (Walter’s) . . . . . . . . . . .

5,725

5,725

– 0 –

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 7,775

$ 6,750

$ 1,025

(Minus) 7.5% of AGI . . . . . . . . . . . . . . . . . . . . . . . . .

(5,953)

(2,982)

(2,971)

Medical expense deduction . . . . . . . . . . . . . . . . . . . .

$

1,822

$ 3,768

$

– 0 –

Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 12,086

$ 8,900

$ 5,132

Subtract total deductions from AGI

. . . . . . . . . . . . . . . .

$ 67,287

$ 30,861

$ 34,480

1,2

Exemptions

(Subtract to find taxable income) . . . . . . . . .

$(18,500)

$ (7,400)

$ (11,100)

1,3

Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 48,787

$ 23,461

$ 23,380

Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6,466

$ 3,096

$

3,081

1,4

Federal income tax withheld . . . . . . . . . . . . . . . . . . . . . .

$

7,708

$ 3,854

$ 3,854

Overpayment (Subtract from Federal tax withheld) . . . . . .

$

1,242

$

758

$

773

Caution: In figuring your tax, use the amounts from your current tax forms instruction booklet for such items as the standard deduction, exemption

1

allowance, and Tax Table tax.

The itemized deductions are greater than the standard deduction (shown here as $11,600 for married filing jointly and $5,800 for married filing

2

separately). Note: If one spouse itemizes, the other must itemize, even if one spouse’s deductions are less than the standard deduction.

An allowance of $3,700 for each exemption claimed is subtracted — 5 on the joint return, 2 on Walter’s separate return, and 3 on Mary’s separate

3

return.

The tax on the joint return is from the column of the 2011 Tax Table for married filing jointly. The tax on Walter’s and Mary’s separate returns is from

4

the column of the 2011 Tax Table for married filing separately.

Table 3. Summary

Tax on joint return . . . . . . . . . . . . . . . .

$ 6,466

Tax on Walter’s separate return . . . . . .

$ 3,096

Tax on Mary’s separate return . . . . . . .

3,081

Total tax filing separate returns . . . . . .

$6,177

Total savings by filing separate returns

$289

Publication 555 (March 2012)

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17