Irs Publication 555 - Community Property Page 8

ADVERTISEMENT

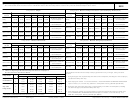

George

Sharon

Spouses living apart all year. If you are married at any

Wages . . . . . . . . . . . . . . . . . . . . . . .

$20,000 $22,000

time during the calendar year, special rules apply for re-

Consulting business . . . . . . . . . . . . .

5,000

porting certain community income. You must meet all the

Partnership . . . . . . . . . . . . . . . . . . . .

10,000

following conditions for these special rules to apply.

Dividends from separate property . . . .

1,000

2,000

Interest from community property . . . .

500

500

1. You and your spouse lived apart all year.

Total . . . . . . . . . . . . . . . . . . . . . . . .

$26,500 $34,500

2. You and your spouse did not file a joint return for a

Under the community property law of their state, all the

tax year beginning or ending in the calendar year.

income is considered community income. (Some states

3. You and/or your spouse had earned income for the

treat income from separate property as separate income—

calendar year that is community income.

check your state law.) Sharon did not take part in George’s

consulting business.

4. You and your spouse have not transferred, directly or

Ordinarily, on their separate returns they would each

indirectly, any of the earned income in condition (3)

report $30,500, half the total community income of $61,000

above between yourselves before the end of the

($26,500 + $34,500). But because they meet the four

year. Do not take into account transfers satisfying

conditions listed earlier under

Spouses living apart all

year,

child support obligations or transfers of very small

they must disregard community property law in reporting

amounts or value.

all their income (except the interest income) from commu-

If all these conditions are met, you and your spouse must

nity property. They each report on their returns only their

report your community income as discussed next. See also

own earnings and other income, and their share of the

Certain community income not treated as community in-

interest income from community property. George reports

come by one

spouse, earlier.

$26,500 and Sharon reports $34,500.

Earned income. Treat earned income that is not trade

Other separated spouses. If you and your spouse are

or business or partnership income as the income of the

separated but do not meet the four conditions discussed

spouse who performed the services to earn the income.

earlier under

Spouses living apart all

year, you must treat

Earned income is wages, salaries, professional fees, and

your income according to the laws of your state. In some

other pay for personal services.

states, income earned after separation but before a decree

Earned income does not include amounts paid by a

of divorce continues to be community income. In other

corporation that are a distribution of earnings and profits

states it is separate income.

rather than a reasonable allowance for personal services

rendered.

End of the Community

Trade or business income. Treat income and related

deductions from a trade or business that is not a partner-

ship as those of the spouse carrying on the trade or

The marital community may end in several ways. When the

business.

marital community ends, the community assets (money

and property) are divided between the spouses. Similarly,

Partnership income or loss. Treat income or loss from

a same-sex couple’s community may end in several ways

a trade or business carried on by a partnership as the

and the community assets must be divided between the

income or loss of the spouse who is the partner.

RDPs or California same-sex spouses.

Separate property income. Treat income from the

Death of spouse. If you own community property and

separate property of one spouse as the income of that

your spouse dies, the total fair market value (FMV) of the

spouse.

community property, including the part that belongs to you,

Social security benefits. Treat social security and

generally becomes the basis of the entire property. For this

equivalent railroad retirement benefits as the income of the

rule to apply, at least half the value of the community

spouse who receives the benefits.

property interest must be includible in your spouse’s gross

estate, whether or not the estate must file a return (this rule

Other income. Treat all other community income, such

does not apply to RDPs and individuals married to a

as dividends, interest, rents, royalties, or gains, as pro-

same-sex spouse in California).

vided under your state’s community property law.

For example, Bob and Ann owned community property

that had a basis of $80,000. When Bob died, his and Ann’s

Example. George and Sharon were married throughout

community property had an FMV of $100,000. One-half of

the year but did not live together at any time during the

the FMV of their community interest was includible in Bob’s

year. Both domiciles were in a community property state.

estate. The basis of Ann’s half of the property is $50,000

They did not file a joint return or transfer any of their earned

after Bob died (half of the $100,000 FMV). The basis of the

income between themselves. During the year their in-

other half to Bob’s heirs is also $50,000.

comes were as follows:

For more information about the basis of assets, see

Publication 551, Basis of Assets.

The above basis rule does not apply if your

!

spouse died in 2010 and the spouse’s executor

elected out of the estate tax, in which case sec-

CAUTION

tion 1022 will apply. See Publication 4895, Tax Treatment

Page 8

Publication 555 (March 2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17