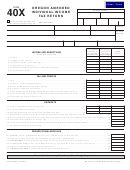

Enter amount of increase or (decrease) to any of the items listed below that are being changed. State the reasons for the changes in the space in line 55.

28. Wages: increase (decrease) . . . . . . . . . . . . . 28 ¨

42. Personal exemptions: increase (decrease). . . 42 ¨

29. Pensions and annuities: increase (decrease) 29 ¨

43. Number of dependent children: increase

× $1,000 . . . . . . . . . . . . . . 43 ¨

30. Mass. bank interest: increase (decrease) . . . 30 ¨

(decrease) _____

44. Age 65 or over exemption

31. Business, profession, farm income:

increase (decrease) . . . . . . . . . . . . . . . . . . . . 31 ¨

You _____ Spouse _____

× $700 . . . . . . . . . . . . . . . . . . . . . . . 44 ¨

Total

32. Rental, royalty, REMIC, partnership, S corp.,

45. Medical exemption: increase (decrease) . . . . 45 ¨

trust income: increase (decrease) . . . . . . . . . 32 ¨

33. Unemployment comp.: increase (decrease) 33 ¨

46. Blindness exemption: increase (decrease)

You _____ Spouse _____

34. Other income (alimony, taxable IRA/Keogh

× $2,200 . . . . . . . . . . . . . . . . . . . . . 46 ¨

Total

dist., winnings, fees): increase (decrease) . . . 34 ¨

47. Adoption fee exemption: increase (decrease) 47 ¨

35. Total increase (decrease) to 5.95 income.

48. Total increase (decrease) to exemptions.

Add lines 28 through 34 and enter total on

page 1, line 5, column B . . . . . . . . . . . . . . . 35 ¨

Add lines 42 through 47 and enter total

on page 1, line 8, column B. . . . . . . . . . . . . 48 ¨

36. Soc. Sec., Medicare, RR, U.S. or Mass. Ret.: increase (decrease).

49. No tax status, limited income credit:

Not more than $2,000 per person.

increase (decrease) . . . . . . . . . . . . . . . . . . . . 49

You ¨ _______ Spouse ¨ _______ Total 36

50. Income tax paid to other state or jurisdiction

37. Child under 15 (child under 13 for tax year 1998), or disabled

credit: increase (decrease) . . . . . . . . . . . . . . 50 ¨

dependent/spouse care expense deduction:

increase (decrease). See instructions . . . . . . 37 ¨

51. Other credits including:

Long-Term Capital Gains Tax Credit

38. Dependent member of household under

age 12 deduction: increase (decrease) . . . . . 38 ¨

Applied to 12% Income

Energy

Lead

Paint

Economic Opportunity Area Credit

39. 50% rental deduction: increase (decrease).

Full Employment Credit

Septic Credit

Not more than $2,500, or $1,250 if married

Increase (decrease) . . . . . . . . . . . . . . . . . . . . 51

filing separately . . . . . . . . . . . . . . . . . . . . . . . . 39 ¨

52. Total increase (decrease) to credits.

40. Other deductions increase (decrease).

Add lines 49 through 51 and enter total

Attach revised Schedule Y & U.S. forms . . . . 40 ¨

on page 1, line 14, column B. . . . . . . . . . . . 52

41. Total increase (decrease) to deductions.

53. Massachusetts withholding. Enter increase

Add lines 36 through 40 and enter total

(decrease) on page 1, line 18, column B. . . 53 ¨

on page 1, line 6, column B. . . . . . . . . . . . . 41 ¨

54. Earned income credit: Number of qualifying children originally claimed _____. Increase (decrease) of qualifying children _____. Total qualifying children ¨_____.

× .10 (10%) $_________.

U.S. credit as originally filed $_________. Increase (decrease) $_________. Correct U.S. credit ¨ $_________

Enter Social Security number(s) of qualifying children in line 55, Explanation of changes.

55. Explanation of changes. Enter the line number for which you are reporting a change and give the reason for each change. If you need more space than is provided

below, attach an additional statement. Also, attach all additional information, supporting forms and schedules. If reporting a federal change, attach federal audit.

Refund Application (substitute application for abatement). For reductions of tax as shown in line 22 on this amended return, and filed after the date of the original return,

the taxpayer named herein makes application for abatement of the tax assessed for the period stated pursuant to the applicable Massachusetts General Laws, Chapter

62. Consent is hereby given, pursuant to Chapter 58A, section 6, for the Commissioner of Revenue to act upon this amended return after six months from the date of fil-

ing. This consent is provided to protect my rights where processing of my refund is delayed for any reason. My consent may be withdrawn at any time. If I refuse consent

by striking out this section, or by withdrawing my consent, the refund will be denied (1) at the expiration of six months from the date of filing or (2) at the date consent is

withdrawn, whichever is later.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of

which he/she has knowledge.

Your signature

Date

Your Social Security number

¨

Spouse’s signature (if filing jointly, both must sign, even if only one had income)

Date

Spouse’s Social Security number

¨

Paid preparer’s signature

Preparer’s E.I. or Social Security number

Address

City/Town

State

Zip

Mail to: Massachusetts Department of Revenue, PO Box 7024, Boston, MA 02204. If making a federal change payment, mail to: Massachusetts

Department of Revenue, PO Box 7020, Boston, MA 02204.

1

1 2

2