Form 1746 Draft - Missouri Sales/use Tax Exemption Application 2010 Page 2

ADVERTISEMENT

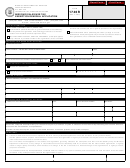

FORM 1746

ORGANIZATION OR AGENCY OFFICERS

6. NAME (LAST, FIRST, MIDDLE INITIAL)

TITLE

SOCIAL SECURITY NUMBER

BIRTHDATE

__

_ _ / _ _ / _ _ _ _

__ __ __ - __ __ - __ __ __

STREET ADDRESS

CITY

STATE

ZIP CODE

__ __ __ __ __

NAME (LAST, FIRST, MIDDLE INITIAL)

TITLE

SOCIAL SECURITY NUMBER

BIRTHDATE

__

_ _ / _ _ / _ _ _ _

__ __ __ - __ __ - __ __ __

STREET ADDRESS

CITY

STATE

ZIP CODE

__ __ __ __ __

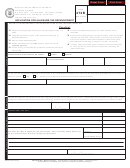

DESCRIPTION OF ORGANIZATION

7.

Brief statement of organizational purpose, its past, present, and proposed activities, and the intended use of the exemption letter.

ATTACHMENTS

Federal or Missouri state agencies, Missouri political subdivisions, elementary and secondary schools operated at public

expense, or schools of higher education are not required to furnish the documents requested in items 8–11 listed below.

8.

If you are a charitable, social, fraternal, civic, ministry, or religious organization, ATTACH a copy of your Internal Revenue Service

exemption letter, Federal Form 501(c). [Churches do not need to attach a 501(c).] NOTE: An IRS exemption letter does not

automatically exempt you from Missouri sales/use tax.

9.

ATTACH a copy of the Certificate of Incorporation or Registration issued by the Missouri Secretary of State, IF REGISTERED OR

INCORPORATED.

10. ATTACH a copy of your Bylaws.

11. ATTACH a complete financial history for the last three years (or number of years in existence if less than three) indicating sources

and amounts of income and a breakdown of expenditures. If just starting the organization, attach an estimated budget for one year.

12. If you are a COOPERATIVE MARKETING ASSOCIATION, attach documentation verifying your payment of the annual registration

fee and ATTACH a copy of your most recent annual report filed with the Missouri Secretary of State.

13. If you are a COOPERATIVE MARKETING ASSOCIATION, attach a copy of the articles of incorporation that details that the

corporation is organized as a nonprofit, non-stock corporation under Section 274.030 RSMo.

SIGNATURE

14. I declare under penalties of perjury that the information reported in this form and any attached supplements is true and correct as to

every material matter; that the present nature, purpose and activities of the above-named organization or agency are the same as they

were when the attached documents were issued and will continue to remain the same; that I will remain knowledgeable of the statutes

and regulations governing sales/use tax exemptions and that I will immediately notify the Missouri Department of Revenue, of any

change in circumstances which could reasonably lead me to believe that the above-named organization or agency would no longer

qualify as exempt, either because of a change in the law or because of a material change in the organization’s or agency’s nature,

purpose or activities.

It is understood that any misrepresentation contained herein or failure on my part to fulfill the promises entered into here will result in

the immediate revocation of any exemption letter issued to this organization or agency.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not

eligible for any tax exemption, credit or abatement if I employ such aliens.

SIGNATURE OF OFFICER OR RESPONSIBLE PERSON

TITLE

DATE

_ _ / _ _ / _ _ _ _

MO 860-2158 (11-2010)

DOR-1746 (11-2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3